Photo-Illustration by Realtor.com; Source: Getty Images

Last week brought hope to the housing market when the Federal Reserve did not raise interest rates. Many predicted this would help keep mortgage rates fairly steady.

But it turns out those predictions were 100% wrong.

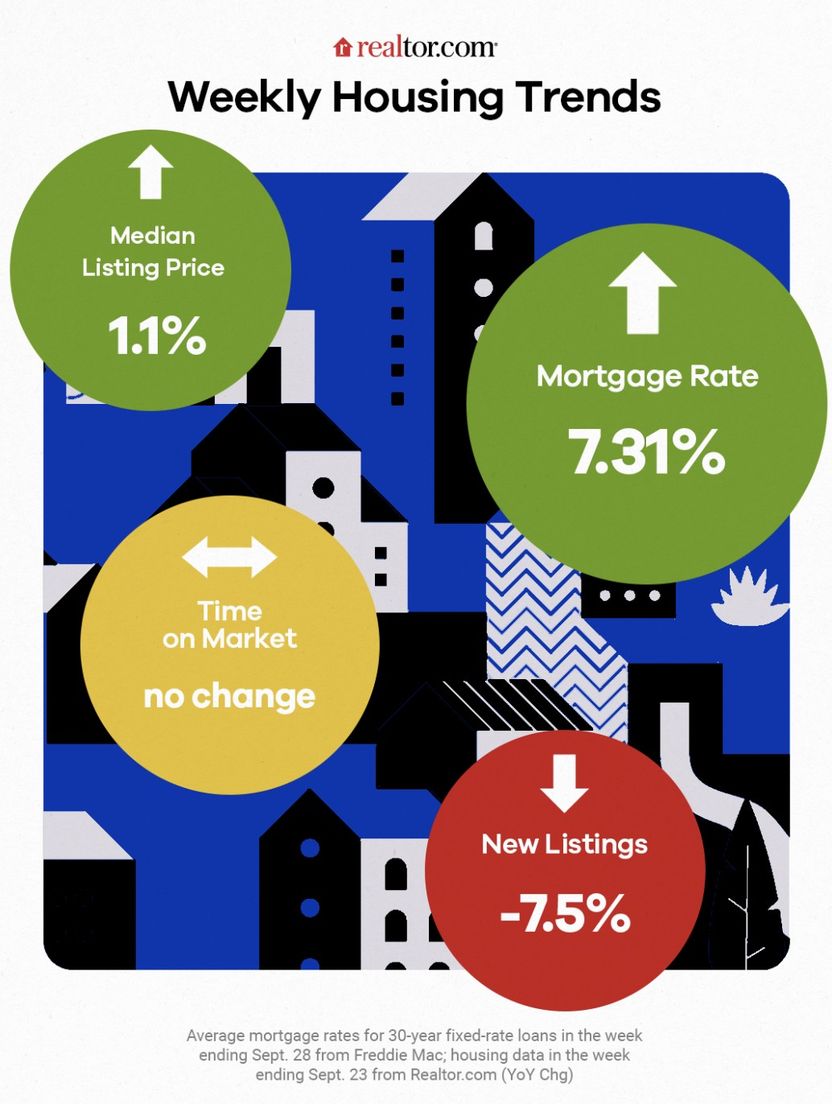

Instead, for the week ending Sept. 28, rates for a 30-year fixed-rate loan rose to their highest level since 2000, landing at an average of 7.31%—a substantial jump from last week’s 7.19%, according to Freddie Mac.

This latest spike in borrowing costs will likely hit today’s already shaky real estate market especially hard.

“Unlike the turn of the millennium, house prices today are rising alongside mortgage rates, primarily due to low inventory,” said Sam Khater, Freddie Mac’s chief economist. “These headwinds are causing both buyers and sellers to hold out for better circumstances.”

In other words, the housing market might be headed even deeper into its ongoing affordability morass.

We’ll break down just what’s happening with the latest real estate statistics for homebuyers and sellers in our column “How’s the Housing Market This Week?”

Why home prices won’t budge

In August, U.S. home prices hovered at a national median of $435,000. And for the week ending Sept. 23, home prices edged 1.1% higher than this same week a year earlier.

While that’s not a significant jump, it’s a tough nut to swallow amid rising borrowing costs.

“It is the 10th consecutive week that we see such a steady upward trend,” says Jiayi Xu, an economist at Realtor.com®, in her analysis.

And while prices thankfully have yet to reach last June’s record-breaking high of $449,000, the current numbers are likely to stay above last year’s levels through 2023.

“It seems likely that we will maintain a slight lead over last year’s figures as we transition into the autumn and winter months,” predicts Xu.

The home inventory blues

Home shoppers need not contend only with high home prices and mortgage rates, but also the prospect of extremely slim pickings.

For the week ending Sept. 23, the number of newly listed homes dropped 7.5% from one year ago, marking the 64th week straight of dwindling new listings. Meanwhile, total for-sale housing inventory (a combination of old and new listings) lagged behind year-ago levels by 3.7%.

“Mortgage rates continued to cause many current homeowners to feel somewhat ‘locked in,’ discouraging them from selling their homes, which, in turn, limits the availability of fresh new listings in the market,” says Xu.

Luckily, homebuyers do have one route around bare-bones listings.

“As the inventory of existing homes remains tight, new construction has emerged as an enticing alternative for prospective buyers,” Xu adds.

Why homebuyers are still eager to close the deal

Meanwhile, the pace of home sales seems to be in a holding pattern.

Typically, a home spends about 46 days on the market before getting snapped up. Amid today’s high interest rates and high home prices, one might expect that pace to stall.

Yet for the week ending Sept. 23, homes sold within the same time period as they did this same week a year earlier, a holding pattern that’s been lingering for three weeks straight.

This data reveals that even in the face of steep affordability issues, buyers aren’t skittish about closing the deal when they can.

“Despite affordability challenges causing a dip in the demand for homes, there’s still a pool of eager homebuyers navigating through a decreasing supply of available houses for sale,” explains Xu.

Plus, statistically speaking, a break in the affordability clouds is coming up fast.

The Realtor.com economic team has identified Oct. 1–7 as the best week to buy a home, when buyers can expect to save more than $15,000 on a home and enjoy 18.9% more new listings compared with the beginning of the year.

In today’s hostile housing environment, homebuyers should take whatever good news they can get.

The post So Much for the Federal Reserve: Mortgage Rates Hit a High Not Seen Since 2000 appeared first on Real Estate News & Insights | realtor.com®.