Getty Images

Attempting to nail down a great deal on a home—or in some cases, any deal on a home—can be soul-crushing in today’s housing market. With mortgage rates at their highest levels in more than two decades, a scarcity of properties for sale, and home prices beginning to tick back up again, those intrepid folks still on the prowl for a place of their own are looking for any breaks they can find.

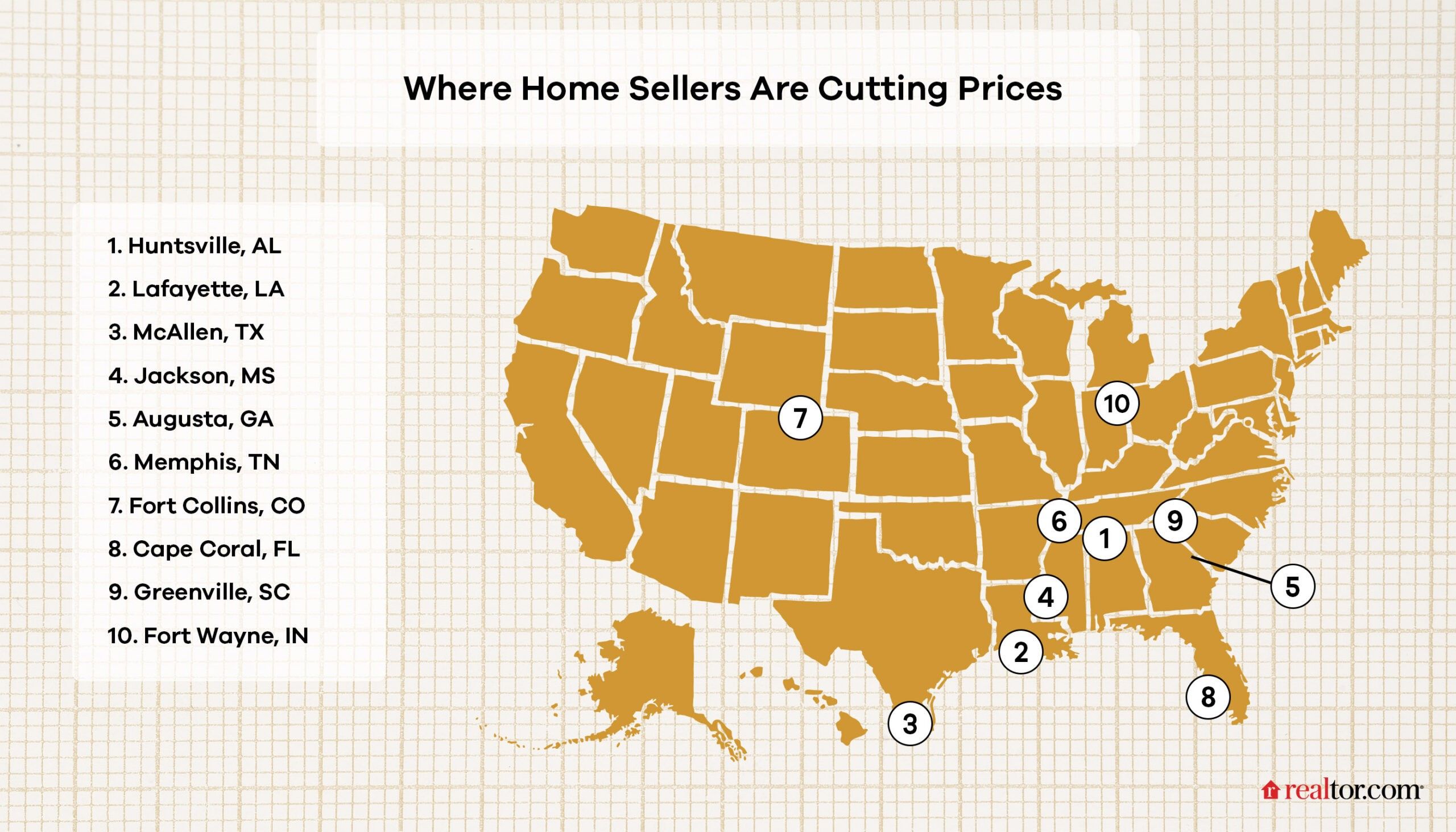

But wait! Despite the parade of bad news, there are a few markets where sellers have been cutting list prices (yes, you read that correctly) to help land buyers. The Realtor.com® data team identified these areas experiencing the largest annual increases in price reductions, where buyers have more bargaining power.

“Generally, there are two things that can drive an increase in price reductions,” says Realtor.com Chief Economist Danielle Hale. “One is if you have more homes on the market. Two is if there is a mismatch between what sellers are expecting and what buyers are willing and able to afford.”

Just 29 of the 150 largest metropolitan areas saw a year-over-year increase in the number of homes with price reductions in July. Across the country, only about 15.5% of all homes listed on Realtor.com underwent a price cut that month. That was down from 19.1% the previous July.

The ones that are currently seeing a spike in price cuts tend to be in the South and Midwest, where the number of homes for sale has been growing along with prices. All but one of our top 10 price-reduced markets experienced a double-digit increase in inventory compared with a year earlier.

“What we’re seeing in the housing market is a reversal of what we saw in the [COVID-19] pandemic,” says Hale. “Areas that attracted a lot of remote workers and saw prices skyrocket are seeing trends slow.”

To come up with our list, we compared the percentage of Realtor.com listings with price reductions in July 2022 with July 2023 in the 150 largest metropolitan areas. (Metros include the main city and surrounding towns, suburbs, and smaller urban areas.)

We limited our list to just one metro per state to achieve geographic diversity.

So where are sellers ramping up the price cuts?

Realtor.com

1. Huntsville, AL

Median home list price in July: $407,000

Increase in price reductions year over year: 69.6%

Builders are driving the price cuts in Huntsville, about two hours north of Birmingham, AL, and two hours south of Nashville, TN. The area is home to NASA’s Marshall Space Flight Center and the government’s nearby defense and intelligence facility, Redstone Arsenal, which has attracted new workers who need places to live. Builders have been striving to meet that demand.

They’ve helped to boost inventory to about 31.5% more active home listings year over year in July, according to Realtor.com data. With more homes for sale, sellers have been forced to compete more for buyers.

“There are some really big, national builders slashing prices to sell their homes,” says local real estate broker Matt Curtis, who has an eponymously named firm. “It does have a trickle-down effect. When builders are lowering prices and offering incentives, it puts pressure on resellers. The [homeowners] have to lower their price to be competitive.”

For example, this three-bedroom, two-bathroom new build had its price reduced by $8,000, to $420,895. (The builder listed it, raised the price, and then lowered it.) Homeowners are cutting prices as well. This three-bedroom, three-bathroom brick ranch on two-thirds of an acre had two price cuts (totaling $20,000); it’s now $349,900.

2. Lafayette, LA

DenisTangneyJr/iStock

Median home list price in July: $265,000

Increase in price reductions year over year: 69.2%

Higher mortgage rates have hammered the housing market in Lafayette.

Even though this mecca for Cajun cuisine is the most affordable metro on this list, many buyers haven’t been able to purchase a home at today’s mortgage rates, says former real estate agent turned consultant Bill Bacque, of Market Scope Consulting.

So homes are sitting on the market longer, leading to about a 33.9% increase in homes on the market year over year in July, according to Realtor.com data.

The tougher market conditions have also led to median list prices dropping 9.4% year over year in the metro.

“It’s a mess,” says Bacque. “We’re starting to see adjustments in the market.”

Sellers reduced the price of this four-bedroom, two-bathroom house on nearly an acre of land on the outskirts of Lafayette by $10,000, to $205,000.

3. McAllen, TX

Median home list price in July: $289,000

Increase in price reductions year over year: 50%

McAllen is a border city located just north of where the U.S. ends and Mexico begins. Home prices in the Rio Grande Valley area, which is popular with shoppers from Texas and Mexico, have historically been lower than in other parts of the country, although they have been rising recently. List prices were up 7% annually in July, according to Realtor.com data.

Meanwhile, the number of homes for sale increased by 40.2% year over year.

This four-bedroom, 3.5-bathroom house on a corner lot has undergone five price cuts since it went on the market in January.

4. Jackson, MS

Getty Images

Median home list price in July: $284,000

Increase in price reductions year over year: 46.2%

The capital of Mississippi experienced one of the nation’s largest home price drops in July, even as prices in other parts of the country surged. Prices fell 8.3% year over year as higher mortgage rates hammered cost-constrained homebuyers.

Part of the reason: The “City With Soul” had 35.5% more homes on the market in July than the same month a year ago. This gave buyers more choices—and bargaining power.

This three-bedroom, two-bathroom ranch is on the market for $99,000 after a $31,000 price cut last month.

5. Augusta, GA

Median home list price in July: $310,000

Increase in price reductions year over year: 41.4%

Augusta, on the South Carolina border more than two hours east of Atlanta, is best known for hosting the Masters Golf Tournament. The U.S. Army Cyber Center of Excellence and Fort Gordon are located just outside of town.

Many of the price cuts here are for homes listed above $300,000, which many buyers can no longer afford with mortgage rates so high, says Carmen Blanchard-Stitt, an associate real estate broker at Meybohm Real Estate.

“Anything over that, we’re seeing a little bit more time on the market, price reductions, seller concessions,” she says.

Concessions can include sellers contributing to buyers’ closing costs, buy-downs on mortgage interest rates, and even the assumption of the sellers’ mortgages with their low rates.

But anything below $300,000 is still going quickly, Blanchard-Stitt says. Still, many deals are falling apart as buyers who were pre-approved for a mortgage with lower rates can no longer qualify for a loan with the higher rates.

Buyers can snag a four-bedroom, two-bathroom ranch with a covered patio for $230,000 after a $5,000 price cut.

6. Memphis, TN

Getty Images

Median home list price in July: $325,000

Increase in price reductions year over year: 22.5%

The “birthplace of rock ‘n’ roll” has long been popular with investors seeking inexpensive homes to flip or rent out. But prices have risen dramatically over the past few years. That’s made it more of a challenge for locals to become homeowners with mortgage rates so high.

The number of listings jumped by 33.2% as homes stayed on the market for about 44% longer in July than they did the previous year.

Buyers can find this four-bedroom, 2.5-bathroom brick beauty on the market for just under $290,000 after two price cuts. This historic three-bedroom, 1.5-bathroom house is down to $280,000 after a $15,000 price cut.

7. Fort Collins, CO

Median home list price in July: $640,000

Increase in price reductions year over year: 18.9%

Fort Collins, about 65 miles north of Denver, is seeing more price cuts as buyers become more choosy, says local real estate agent Andria Stashak, of Seed Property Group.

Buyers watched as prices surged during the pandemic—and then came down a little earlier this year as mortgage rates rose. Prices were up just 0.7% year over year in July, according to Realtor.com data.

That’s made some worry that home prices could be flat for years to come, not allowing them to build up the equity they might have hoped to do over the short term, says Stashak. So they’re not going to buy just any old house.

“They have the ability to be more picky and negotiate right now,” says Stashak. Sellers have responded by cutting prices.

In addition, there were 26.6% more listings in July than a year ago. Some were from investors who bought up homes to rent out on sites like Airbnb. When they didn’t make as much as they hoped, they put those properties on the sales market, she says.

Buyers “want to see turnkey, and they’re not open to really covering appraisal gaps,” says Stashak.

Builders have been shaving thousands of dollars off their inventory of newly constructed homes. They lopped nearly $40,000 off this three-bedroom, 2.5-bathroom townhouse since it went on the market in July, bringing the price down to $499,000.

8. Cape Coral, FL

Wicki58/iStock

Median home list price in July: $480,000

Increase in price reductions year over year: 15.8%

The story of Cape Coral differs from many of the other places on this list. Last September, the area on Florida’s southern, west coast was hit by Hurricane Ian. Homes were damaged or destroyed by the storm, beaches were closed, and hotels and resorts temporarily shuttered their operations. So buyers hailing from other parts of the country didn’t fly in to go home shopping.

This year, the number of homes for sale in the metro surged by 51.1% in July compared with the previous year. The inventory increase is a result of homeowners who want a new start somewhere else or are tired of waiting on their insurance money, says local real estate agent Nelson Rua, of Coldwell Banker Realty. It’s also due to new construction going up in the northwestern part of the city.

Some are so eager to move on with their lives that they’ve reduced their prices. Others were forced to reassess what they were asking for when buyers weren’t willing to pay what they wanted for damaged properties. Some reductions were due to buyers being cautious after they drove through badly damaged neighborhoods of homes with blue tarps for roofs.

About 90% of Rua’s clients are from out of state, hailing from Illinois, New York, New Jersey, and other northern Midwestern states.

“Price reductions were desperate people trying to get out of the area,” says Rua.

9. Greenville, SC

Median home list price in July: $356,500

Increase in price reductions year over year: 15.1%

Greenville has been growing for decades. The lively little upstate city more than three hours northwest of Charleston has attracted large employers such as BMW and Michelin, has universities, and boasts a thriving arts and dining scene downtown. It’s emerged as a popular place for young families, professionals, and retirees.

Builders have been putting up homes and creating developments all over the metropolitan area. But despite the new construction, the metro had the lowest number of new listings, a 5% year-over-year increase, of any of the places on our list. What is available is taking longer to sell, with days on the market increasing about 26.5% year over year in July.

This newly constructed four-bedroom, three-bathroom house has had its price changed eight times since it was listed in April, dropping to $349,900.

10. Fort Wayne, IN

Davel5957/iStock

Median home list price in July: $350,000

Increase in price reductions year over year: 13.8%

Fort Wayne, about 2.5 hours northeast of Indianapolis, has been named one of the top emerging housing markets this year by Realtor.com and the Wall Street Journal. So why are sellers slashing prices? They got overly ambitious in their pricing, says local real estate broker Beth Walker, of the Fairfield Group Realtors.

Most of the reductions are on the higher-priced homes, she says.

“Some sellers are coming on the market [set] on a price that our upward [price] trajectory of the last few years would suggest they should be able to sell for,” she says. However, “there may not be as many buyers to buy those homes due in part to the interest rates. Buyers can’t buy as much.”

Competition remains fierce for homes priced below $250,000, with these properties often receiving multiple offers.

This three-bedroom, 2.5-bath ranch boasting lake views and beach and boating privileges underwent a $10,000 price cut, bringing the final price down to $325,000.

The post Attention, Homebuyers! Here Are the Cities Where Sellers Are Slashing Prices the Most Right Now appeared first on Real Estate News & Insights | realtor.com®.