Photo-Illustration by Realtor.com; Source: Getty Images

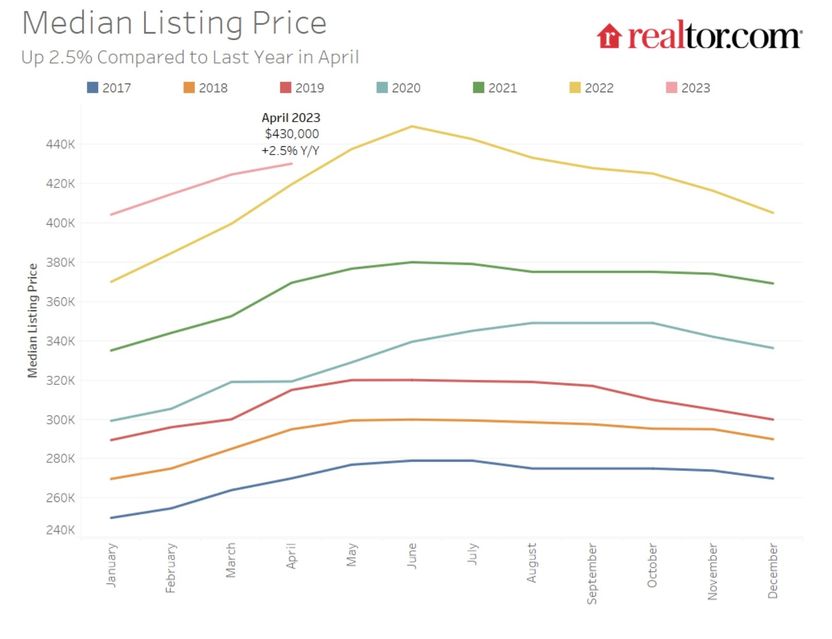

America’s home prices are still rising, currently hovering at a median of $430,000 in April. But at long last, these sky-high housing costs seem poised to fall, perhaps as early as this month.

That’s according to a new report from Realtor.com®, which found that April’s listing prices had ticked up a mere 2.5% compared with a year earlier. That’s the slowest yearly price growth seen since April 2020, when COVID-19 quarantines forced the real estate market to grind to a halt.

Once markets opened up again, the pandemic unleashed a steep and unprecedented ascent in home prices, culminating in a record-setting high of $449,000 last June. But the latest data suggests that this raging seller’s market might have finally reached its peak and will soon peter out.

“At this rate of slowing, listing prices are likely to decline relative to the previous year sometime in May,” predicts Realtor.com Chief Economist Danielle Hale in her latest analysis of housing trends. “For buyers, decelerating and potentially declining listing prices could be a welcome reprieve.”

Realtor.com

Why home prices and mortgage rates might have peaked

And here’s more good news for May: As long as inflation continues to lose steam, mortgage interest rates might soon die down as well.

“With the rate of inflation decelerating, rates should gently decline over the course of 2023,” Sam Khater, chief economist of Freddie Mac, predicted recently.

This double dose of hope might be just what homebuyers need to hear right now to hit some open houses and forge ahead.

“We may see an improvement in affordability compared to the previous year in the coming months,” Hale continues. However, “it’s important to note that affordability is expected to continue to create headwinds for many homebuyers this year.”

Indeed, the monthly cost of financing 80% of a typical home is 19% higher than a year ago, which amounts to an extra $340 per month.

Until these costs decline, the housing market might remain largely locked in a staring contest, with homebuyers waiting for prices to fall and sellers waiting for more buyers to come off the sidelines.

“Some buyers and sellers may want to wait,” says Lawrence Yun, chief economist for the National Association of Realtors®.

Yet waiting carries some risks.

“Home prices could be bid up when rates are lower, rather than buyers being able to negotiate for a better price now and then refinance if the rates were to go down,” Yun explains. “With inventory so short, it is unclear if the right home for the price on the market now shows up later.”

Why lower home prices and mortgage rates might not be enough

Although homes might soon cost a bit less, homebuyers may face other problems. For one, there just aren’t enough homes for sale.

Although this April saw 48.3% more listings than a year earlier, inventory “is still well below pre-pandemic levels,” Hale notes. “This means that there were still fewer homes available to buy on a typical day in April than there were a few years ago.”

Plus, April’s inventory growth rate slowed for the second month in a row, with 21.3% fewer fresh properties being added to the overall mix that month.

Many sellers held off on listing because they feel “locked in” by their current low mortgage rates.

Plus, the prospect of selling might seem less enticing, now that the red-hot seller’s market of the past couple of years is on the wane.

In April, 12.2% of listed homes had price cuts. That’s below the 2017–19 average, Hale points out, suggesting that “sellers may be setting their initial asking price to be more in line with buyer expectations than was typical before the pandemic.”

Homes are also lingering on the market, at a median of 49 days in April. That’s 17 days longer than last year, although still shorter than before the pandemic.

Nonetheless, the future looks bright for many sellers, particularly if they’ve owned their home for a while.

“Sellers who have built up home equity are better positioned to find their next home in a cooling market,” Hale says. But they “may need to temper expectations for the sale of their current home.”

Where affordable housing markets are hiding

In the meantime, homebuyers are scrounging far and wide for affordable homes.

Many have targeted less costly metros in the middle of the country, although this, in turn, has caused prices to begin rising in these areas. Prices were up the most compared with a year earlier in Memphis, TN (31.7%), Milwaukee (21.7%), and Kansas City, MO (21.1%).

On the flip side, areas that pulled in the most newcomers during the pandemic—and where prices boomed—are now reversing many of those patterns. The greatest price declines were seen in Austin, TX, where prices were down 8.8% year over year; Las Vegas, where they fell 7.1%; and Houston, down 4.6%.

Yun thinks many of the long-distance moves sparked by the onset of remote work in 2020 might be coming to an end, but work arrangements will still play a role in determining where people live.

“Long-distance regional moves will be limited—for example, moving to the very affordable market of Cincinnati from San Francisco,” he says. “But going to the next county and outer suburbs will be popular. Homes are more affordable in the outer rings, and those with the option to occasionally work from home will not have to commute every day.”

The post Have Home Prices and Mortgage Rates Both Peaked? A Hopeful Look Ahead appeared first on Real Estate News & Insights | realtor.com®.