Getty Images

Although the fall season is traditionally the best time of year to buy a house, homebuyers out there right now might not feel that way—and for good reason.

We looked at the latest real estate statistics in our column “How’s the Housing Market This Week?” We found that this year’s seasonal high point for buyers is up against some strong headwinds—including skyrocketing interest rates, soaring inflation, and overall economic volatility not seen since the Great Recession in 2008.

“Early fall is usually the best time to buy,” says Realtor.com® economist Jiayi Xu in her analysis, adding that the most optimal window of opportunity for homebuyers nationwide just passed last week.

However, she continues, “as inflation remains close to a 40-year high and outpaces wage growth, home purchasing will continue to present challenges for many. While the labor market remains strong, buyers’ hesitation continues to spread as they face much higher costs for similar homes.”

To help shed light on this odd contradiction in the housing market today, here’s how four key indicators stack up—interest rates, home prices, number of homes for sale, and time on the market—and what they mean for both homebuyers and sellers.

A double whammy: Higher mortgage rates and home prices

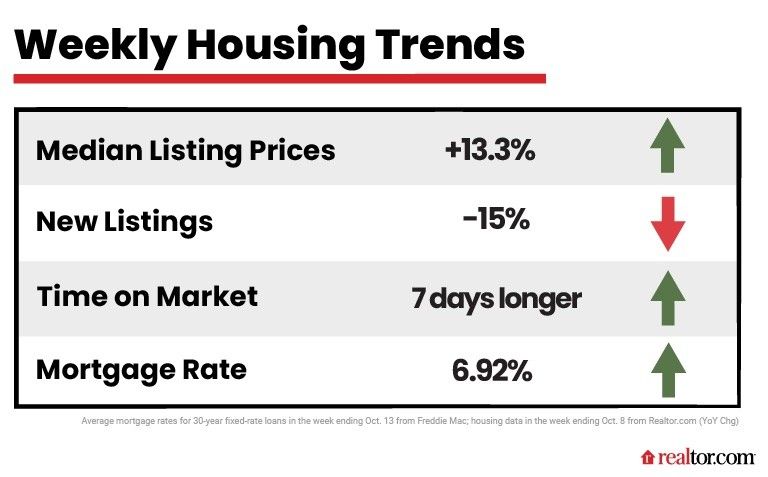

Currently, home prices hover at a national median of $427,000—and for the week ending Oct. 8, prices continued to rise by 13.3% compared with the same week last year, marking the 41st straight week of double-digit price growth.

Making matters worse, this year alone saw mortgage rates double from the 3% to 6%-plus range—and for the week ending Oct. 13, the average 30-year fixed mortgage rate edged up even further from last week’s 6.66% to 6.92%, according to Freddie Mac.

All of this means homebuyers will have to pay much more for a house. But there is some glimmers of respite on the horizon.

“The pace of year-over-year growth has remained slow,” says Xu, who takes this as a “sign of prices beginning to adjust to soaring mortgage rates that have hampered the purchasing power of buyers.”

Home prices are also heading south seasonally from their record-high peak in June of $450,000, and many experts predict they will continue to fall next year. Nonetheless, some worry this relief may not be enough for all homebuyers.

“Even with an anticipated fall in home prices in some markets—principally in California—homes will continue to be unaffordable,” National Association of Realtors® Chief Economist Lawrence Yun predicts in a statement following the release of recent Consumer Price Index inflation data. “Even with an economic recession looming, the Federal Reserve is unlikely to let up in its aggressive monetary policy of raising interest rates. Mortgage rates will be fighting to hold at a 7% average rate in the upcoming weeks.”

A surprising upside for buyers: More homes for sale

High mortgage rates and home prices do amount to some sort of consolation prize for buyers: a wider selection of homes on the market.

For the week ending Oct. 8, overall housing inventory grew considerably, up by 31% over this same week last year.

“After a period of unusually hot activity, financial conditions are cooling demand in the housing market,” says Xu. “There are substantially more homes for sale compared to one year ago.”

And these homes are sticking around on the market longer, too: While properties currently linger on the market for a median of 50 days, for the week ending Oct. 8, they spent 7 more days on the market compared with a year earlier, a pace that’s slowed for 11 weeks straight.

“The slower seasonal pattern and the rebalancing market enable homes to sit for a longer time,” adds Xu, “providing buyers more time to find good deals and think through purchasing options before missing out.”

The downside for shoppers: A greater share of stale listings

Yet, while buyers have more options and more time to browse, they may notice that the overall mix of listings has grown stale, without as many fresh listings they haven’t seen before.

For the week ending Oct. 8, the number of new listings on the market dropped by 15% compared with this same time last year. That’s the 14th straight week of year-over-year declines.

Why are so many sellers skittish to list? Because the majority are also homebuyers, leery of trading in their current (and likely low interest rate) mortgage for a new one at today’s higher rates.

“As mortgage rates near 7%, which is a level not seen in more than two decades, sellers who are also trying to buy a home—nearly 3 of every 4 potential sellers—have had to alter their trade-up plans,” says Xu. “It appears that many have put selling on hold despite record levels of home equity, as higher mortgage rates and home prices sap purchasing power.”

Why today’s housing market hasn’t fully recovered from COVID-19

Aside from inflation, high interest rates, and a looming recession, part of the problem for buyers may simply be that the housing market hasn’t fully recovered from the coronavirus pandemic. As proof, one need only compare today’s market conditions with what they were three years earlier.

For instance, today’s inventory level may be 30% higher than a year ago, but it still falls 40% short of the housing stock available in 2019.

“Highlighting the roller-coaster ride that the housing market and its participants have been on in the last few years, one’s take on the current number of homes for sale depends very much on the comparison point,” explains Xu.

The same can be said about the pace of home sales, which may be slowing, but is still much faster than it was pre-pandemic.

“Homes are selling more than two weeks faster than they did in 2019,” says Xu. “As a result, buyers who are prepared to act quickly with their finances in order and their pre-approval ready to go will still have an edge.”

The post This Fall’s Latest Housing Stats Are Hiding a Surprising Upside for Homebuyers appeared first on Real Estate News & Insights | realtor.com®.