Getty Images

Mortgage payments that grew more expensive over time were one of the main culprits of the housing bust that led to a worldwide, financial disaster in the mid-2000s. And now one of the types of loans that defined that era is staging a comeback.

More homebuyers are choosing adjustable-rate mortgages, which offer lower monthly payments initially, to contend with record-high home prices. Those lower monthly payments, instead of traditional 30-year fixed-rate mortgages, are proving to be a strong lure for buyers looking to afford a home in the white-hot housing market.

Applications for ARMs had been steadily growing and were up 12.5% year over year in the week ending June 18, although they fell in the following week, according to the Mortgage Bankers Association.

“The epic surge in home prices has people looking to save money on monthly payments anywhere they can,” says Matt Graham, chief of operations at the industry publication Mortgage News Daily.

But buyer be warned: The mortgage rate on these loans resets after a set period of years, usually five or 10.

If rates go down or if borrowers plan to sell their homes around that time, that’s good news. But if rates go up, they will pay more to reflect the rates in place at that time.

That means it’s likely that borrowers receiving ARMs at today’s historically lower rates will be saddled with higher housing payments down the line as mortgage rates are expected to climb. While this isn’t expected to trigger a repeat of the foreclosure crisis, many of today’s buyers may not fully understand what this means.

“Given how low rates are, it is a safe bet that they will go up in the years to come,” says real estate professor Stijn Van Nieuwerburgh, at Columbia University in New York City. “How much, nobody knows.”

The average rate for an ARM was 2.98% in the week ending June 25, according to MBA data. It was 3.2% for 30-year fixed-rate loans. (This was for contract-only rates—i.e., ones that did not factor in points that borrowers often purchase to bring down rates, for buyers who put 20% down.)

While those differences in rates may seem minor, they can add up to big money over time.

For some buyers that risk is worth being able to afford to own a home, especially since new regulations have made ARMs safer than they were during the Great Recession. In the wake of the crisis, only the most qualified borrowers are approved—and there is more education around these types of loans.

That’s a big departure from the 2000s, when homebuyers were pressured into loans that they couldn’t afford. They then defaulted en masse when their initially low mortgage payments suddenly grew too expensive.

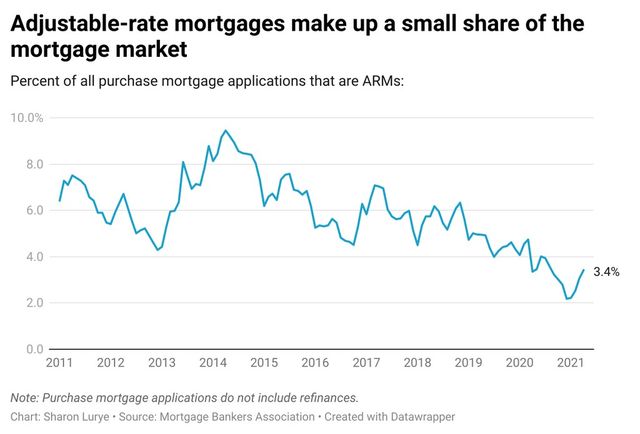

ARMs are still a fairly small part of the mortgage market, making up just 3.6% of applications in the week ending June 25, according to MBA data. But their share of the market has been growing since December. They are also especially popular for more expensive mortgages. The average loan size for an ARM was nearly $904,000, compared with $317,500 for a fixed-rate loan in the week ending June 25, according to the MBA data.

“People will start to make the decision that, yes, the 30-year fixed [offers] security, but the difference in payment on the ARM is worth me taking the risk,” says Esther Phillips, a senior vice president at Key Mortgage Services in Schaumburg, IL.

Who should get an ARM?

While many experts say ARMs aren’t a good deal for most homeowners who plan to stay in their house for decades, they do offer some upsides.

Personal-finance expert Claire Hunsaker got an adjustable rate on both her own home and two investment properties she rented out in the San Francisco Bay Area. Her first experience with an ARM went surprisingly well. Since she made extra payments to pay off more of the principal of the loan, when the interest rate adjusted, it was calculated based off of a lower base amount. So her mortgage payments were even lower than she had expected.

“I hadn’t really thought about the amount of flexibility it gives you to have … control over potentially lowering your rate,” says Hunsaker. She is the CEO of AskFlossie.com, an online financial community for women. This worked only because she paid more on the loan than was due.

However, there are some types of loans that she would suggest homebuyers avoid.

They include interest-only mortgages, where borrowers pay only the interest on their loan for the first three to 10 years. She’s also not a fan of payment-option ARMs, where borrowers can pay less interest than they owe in exchange for that interest getting added to the principal (main loan amount).

These types of mortgages are cheap at first, but can ratchet up quickly. In both cases, homeowners aren’t doing anything to pay off the principal, and in the case of a payment-option ARM, the principal could actually get bigger.

“That’s where people get in trouble, if they’re not paying down principal and building equity,” says Phillips. That leads to a big risk that people could end up underwater, meaning they owe more than their house is worth.

“That was a big reason people got into trouble on ARMs,” she adds.

Sharon Lurye for Realtor.com

Experts do note that there are far more regulations nowadays to prevent that kind of trouble. Interest-only loans are very rare, and buyers who want an ARM usually need higher credit scores and must put more money down than buyers who want a fixed-rate mortgage.

As a result, ARMs are “not really a concern based on what we can see at the moment,” says Graham.

Think about your exit strategy

There’s another big change spurring the current popularity of ARMs: a change of how the interest rates are calculated. Many banks used to base the interest rate for an ARM on an index called the London Interbank Offered Rate, or LIBOR, which was a number calculated by bankers in London. But scandal and controversy have plagued the LIBOR in recent years, so now most U.S. lenders are phasing it out.

These lenders are turning instead to a rate called the Secured Overnight Financing Rate, or SOFR, which is supposed to be more resistant to manipulation.

“Now that there’s a much more stable index that’s being utilized, there’s more of a market for [ARMs],”says Phillips.

But the inherent risks of ARMs for some buyers persist. ARMs that are based on the SOFR adjust twice a year. That means that after the initial period of stability, the size of mortgage payments could change every six months. (The “adjustment period” refers to the amount of time between mortgage rate changes, which can range from once every month to once every five years.)

Phillips says the most important thing for homebuyers to do if they want to get an ARM is plan out what they’ll do once the interest rate adjusts. Do they plan to move out of the house before that happens? Do they know how they’ll afford it if the rate goes up?

“You have to think about what’s your exit strategy,” she says. “You’re taking advantage of this lower payment now, which is great. But what happens if it goes up in seven years?”

The post Why More Homebuyers Now Are Turning to This Much Riskier Type of Mortgage appeared first on Real Estate News & Insights | realtor.com®.