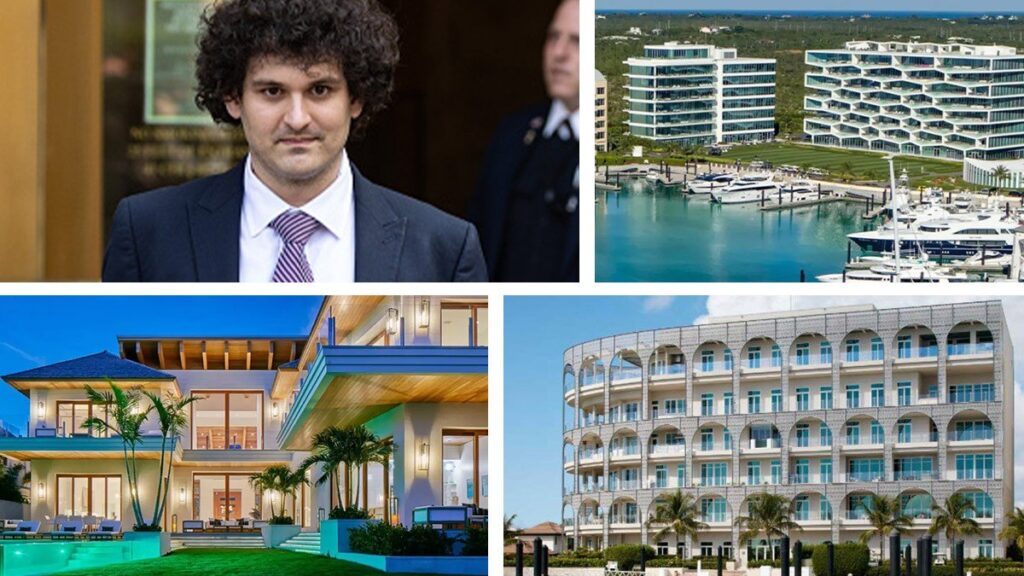

Seaside Real Estate; Albany Bahamas; Yuki Iwamura/Bloomberg via Getty Images

Convicted crypto fraudster Sam Bankman-Fried was sentenced to 25 years in prison on Thursday, but his Bahamas real estate holdings are about to be set free in the market.

Prior to his arrest in the staggering $8 billion fraud that led to the November 2022 collapse of his cryptocurrency exchange FTX, Bankman-Fried presided over a sprawling property portfolio in Nassau, where the company was headquartered.

Prosecutors say he stole billions in client funds to prop up his hedge fund, splash out political donations, and snap up the luxury properties across Nassau for his friends, family, and fellow FTX executives.

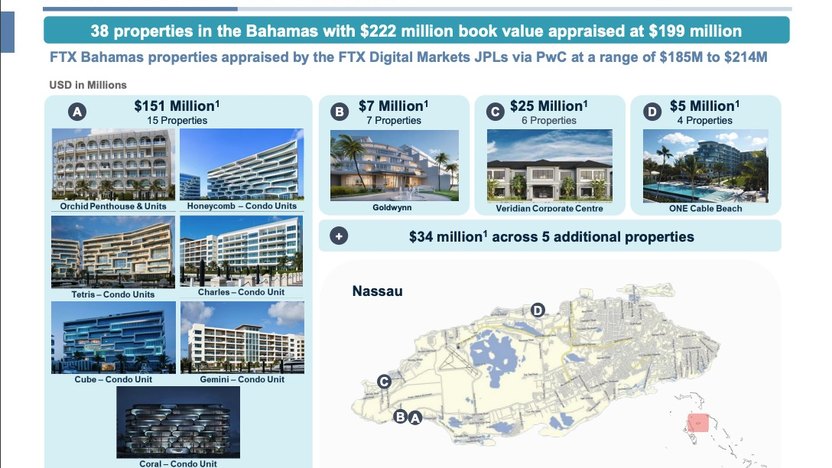

After a lengthy process in bankruptcy court, FTX has clawed back some 38 Bahamas properties—worth $222 million—from Bankman-Fried and other executives. The list includes the notorious waterfront penthouse where he lived with a rotating cast of up to eight roommates.

Now, the company is preparing to sell off that real estate to help pay back a long list of creditors, including thousands of defrauded customers who have filed claims totaling $16 billion. The sale of the properties is being managed through federal bankruptcy court in Delaware, and is separate from the criminal proceedings against Bankman-Fried in Manhattan federal court.

The properties set to hit the market in the coming weeks include more than two dozen luxury units in beachfront condominiums, multiple single-family lots, and extensive commercial real estate holdings around New Providence island, home to Nassau.

Listings for some of the properties should be posted by early April, according to Matthew Marco, a luxury real estate specialist with Bond Bahamas.

“The demand for these types of properties is extremely strong, so don’t expect any deals,” says Marco.

Alex Wong/Getty Images

The Bahamas properties that will go up for sale

The jewel of Bankman-Fried’s former real estate empire is the penthouse unit in the Orchid building at Albany Bahamas, a luxury resort community where Tiger Woods hosts an annual golf tournament.

The penthouse was purchased for $30 million in March 2022 by FTX subsidiary unit FTX Property, with records reported by Reuters indicating that it was intended as a “residence for key personnel.”

The five-bedroom, 12,000-square-foot penthouse includes a private balcony with a lounge and spa area overlooking the community’s superyacht marina.

Bankman-Fried’s roommates in the penthouse included fellow FTX execs Zixiao “Gary” Wang and Nishad Singh, as well as Caroline Ellison, his on-and-off girlfriend who ran affiliated hedge fund Alameda Research. All three pleaded guilty to criminal charges in the FTX fiasco and testified against Bankman-Fried at his trial.

The penthouse, designed by Morris Adjmi Architects, was listed for nearly $40 million soon after FTX declared bankruptcy in November 2022. But the listing was quickly pulled down as FTX bankruptcy managers moved to lock down the company’s assets for court-approved liquidation. The penthouse is currently controlled by FTX and is expected to hit the market in the coming weeks, according to court filings.

MLS

In addition to the Orchid penthouse, FTX is preparing to list 15 other properties in the Albany resort community, according to court records. They include two other condos in Orchid; three units in Charles; one unit each in the Choral, Cube, and Gemini buildings; three each in Honeycomb and Tetris; and a lot in the Albany subdivision. FTX values the Albany properties at $151 million altogether.

Other FTX properties set to hit the market include seven luxury condominium units valued at $7 million in Goldwynn Resort & Residences overlooking Goodman’s Bay.

FTX will also sell four condos valued at $5 million in the One Cable Beach development, where records show Singh, Wang, and Bankman-Fried purchased units for residential use.

Commercial properties set to be sold include office spaces worth $25 million in the Veridian Corporate Center, Pineapple House on Western Road, Ocean Terrace on West Bay Street, and the West Bay property where the company had planned to build its headquarters.

The list also includes an unspecified property on Blake Road and two adjoining single-family lots in Old Fort Bay, a private gated community just east of Lyford Cay.

$16.4M vacation home of fraudster’s parents remains in limbo

Notably, the list of FTX properties in the Bahamas that a bankruptcy judge approved for sale in January does not include the vacation home once owned by Bankman-Fried’s parents, Stanford law professors Joseph Bankman and Barbara Fried.

Known as “Blue Water,” the 30,000-square-foot luxury home with beach views in Old Fort Bay was purchased for $16.4 million in February 2022. Although Bankman and Fried signed the purchase agreement, the funds to buy the home were provided by FTX, the company alleged in court filings.

Old Fort Bay, an exclusive gated community, was once the site of a British Colonial fort built in the 1700s to protect against pirates of the Caribbean.

Soon after the implosion of FTX, Bankman and Fried, who have not been criminally charged in the case, insisted they planned to voluntarily return the lavish Bahamas home.

But as late as September 2023, FTX alleged in a lawsuit against the couple that “the title to the property remains in Bankman’s and Fried’s names and all available information indicates that Bankman and Fried still retain title to the property.”

Bankman and his attorney Krystal Rolle told Realtor.com in emails this week that the title to Blue Water is no longer in his name.

“We were told by our counsel that the title to the property was transferred to the Bahama company that always had beneficial ownership of it over a year ago,” wrote Bankman. Rolle said the title conveyance had been finalized.

US Bankruptcy Court

In an amended complaint earlier this month, attorneys for FTX conceded that “Bankman and Fried have purportedly transferred the property” to FTX Digital Markets, a Bahamian affiliate that is not an official debtor in the U.S. bankruptcy proceedings.

A settlement agreement between FTX Digital Markets and the FTX debtors in U.S. bankruptcy court should allow for the home’s sale to pay customer claims. Still, attorneys for FTX expressed concerns in court filings that they might not be able to recoup the full value of the property. They also slammed Bankman and Fried for accepting the home.

“Both Bankman and Fried were familiar with the FTX Group’s haphazard internal controls and were made aware of numerous red flags indicating that their son and other Insiders were breaching their fiduciary duties,” they wrote in the amended complaint.

“Yet, even as sophisticated law professors, Bankman and Fried chose to live in a multi-million dollar home in The Bahamas funded by the fly-by-night corporate organization with which they were so familiar.”

It’s unclear when Blue Water might hit the market. FTX’s bankruptcy administrators did not respond to a request for comment.

The post EXCLUSIVE: Sam Bankman-Fried’s $222M Bahamas Real Estate Empire Is About To Hit the Market as He’s Sentenced to 25 Years for FTX Fraud appeared first on Real Estate News & Insights | realtor.com®.