Grace Lucchese / Realtor.com

Mickey Ricard and Grace Lucchese were excited to buy their first home together. But these 24-year-olds knew they faced a tough market, with many listings around the Boston area nearly double what they could afford—and interest rates hovering in the mid-7% range.

“We’d seen some dumps,” Lucchese admits. “We were discouraged. Then my mom was on Realtor.com® and saw this house and was like, ‘You have to go see it.’”

The three-bedroom Colonial in Westford, MA, was listed for $429,000. While the 1885 build was a little run-down and in need of repairs, Ricard and Lucchese were delighted to see that the property had not just one but two living rooms and a fenced yard for their mutt Moon. It was also within walking distance of Freedom Park and the beach at Forge Pond.

Realtor.com

“We came, fell in love, and put in an offer literally walking out the door,” says Lucchese.

But the real selling point of this property emerged during the negotiations that followed.

“We were trying to talk the seller down on the price when he brought up the fact that we could assume his loan,” says Ricard. “At first, we didn’t know what that was.”

Ricard and Lucchese learned that an assumable mortgage would allow them to essentially “take over” the seller’s mortgage—as well as its 2.6% interest rate.

Rates at that time hovered at 7.6%, so “our mortgage payment would go from $3,800 to $1,700 per month,” Lucchese recalls. “It was the deal of the century, a loophole, like winning the lottery.”

After hearing this, these young homebuyers were all for moving ahead. Getting their lender on board, however, was another story.

Grace Lucchese

Why assumable loans are in demand—but not easy to obtain

While assumable mortgages have been around for decades, few have heard of them because the right conditions to make them a once-in-a-generation windfall have never really clicked into place until now.

“With the dramatic spike in rates, there is an opportunity there,” says Jerry Devlin of Assume Loans, a company in Brookline, MA, that he co-founded in September to help this type of borrower navigate this relatively unknown transaction.

Granted, not all loans are assumable, and conventional loans typically won’t qualify. The main types of assumable loans include FHA, VA, and USDA loans. And they constitute a sizable chunk of today’s housing inventory.

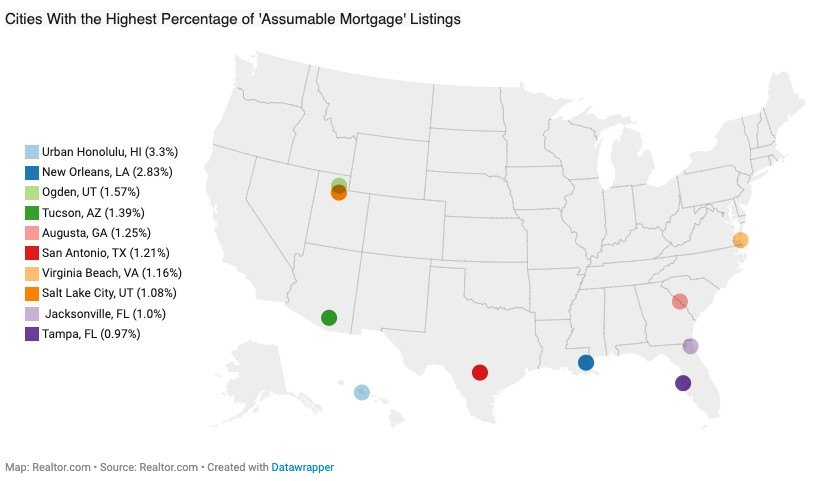

Realtor.com data suggests that about 6% of homes for sale across the U.S. are eligible for assumption. A small percentage of listings (0.4% nationally) advertise their loan’s assumability as a perk, with the highest share seen in Honolulu (3.3%); New Orleans (2.8%); Ogden–Clearfield, UT (1.6%); Tucson, AZ (1.4%); and Augusta, GA (1.3%).

Realtor.com

“Many of the areas with a high share of listings mentioning an assumable mortgage are home to or near a military base, and therefore see a larger share of VA loans, which are assumable,” says Realtor.com economic research analyst Hannah Jones of her research.

Given that about 29% of homeowners have loans with rates below 3%, assumable loans offer the potential to save homebuyers hundreds or even thousands of dollars per month. Sellers can also benefit and fetch a higher sales price on their home.

Yet despite this win-win scenario, assumable loans are still so rare, they’ve developed a reputation as being the “unicorn of all homebuying transactions.”

Why? Some say it’s because there’s not much in it for lenders.

Ricard and Lucchese got this impression after approaching the seller’s bank, PennyMac, saying they’d like to assume the seller’s loan.

“Their response was, ‘You’re not buying this house unless you’re buying it with a regular loan,’” Ricard recalls. “They just didn’t want to do the assumption because they don’t make money.”

When the couple insisted on moving forward with the assumable loan, they were informed that these mortgages were handled by a “special service group” reachable only by fax.

Whenever they tried calling to check in, no one responded, Ricard recalls. “They kept on basically pushing us off to everybody else in the company.”

Luckily, they had decided to hire some muscle to help push this loan through: Mark McDonough, a principal at Assume Loans, who says that the runaround his clients experienced is sadly the norm with many lenders.

“There’s a shadow world of accounting that makes sense to jerk people around on assumptions,” he says. “Most are structured the same way—with a hidden assumptions loan group, reachable by fax, nobody calls back, no way to follow up.”

Yet based on his decades of experience in the loan industry, McDonough adds, “We know when someone is putting up an artificial wall. And it’s almost fun getting around it. It’s like solving a puzzle. We know where all the bodies are buried, when a lender is violating regulations.”

McDonough knew exactly how to get PennyMac moving: Bypass the “special service” fax line and submit to one of PennyMac’s licensed loan officers six key pieces of information known as ALIENS, an acronym of the following:

- Address of the property

- Loan amount requested

- Income of applicant

- Estimated value of mortgage loan application

- Names of borrowers

- Social Security numbers

By law, once ALIENS has been received, the clock starts ticking: A lender has 30 days to render a credit decision on the applicant and 45 days to close.

But even then, McDonough and his clients were met with resistance.

“The loan officer said, ‘I don’t know what to do with an assumable loan,’” McDonough recalls. “I said, ‘That’s not my problem. You don’t have that right.’ I also sent complaints to everyone in their C-suite. … That ends up getting attention and gets things done.”

Grace Lucchese

Assumable loans: Good for buyers, bad for lenders?

So why, exactly, do lenders drag their feet on assumable loans—is it really all about the money?

The math certainly seems to support this suspicion. Conventional loans come with hefty closing costs ranging from 2% to 7% of a home’s purchase price. On an assumable loan, however, fees are capped at a mere $300 for VA loans and $900 for FHA.

In 2022, the Mortgage Bankers Association issued a request to the Federal Housing Administration to increase the allowable fees on both VA and FHA loan assumptions to $3,500. But this request was not granted.

Devlin also concedes that many lenders might be slow on assumable loans since they aren’t used to dealing with them, and also lack the resources to give them the attention they require.

Steve Bailey, senior managing director and chief servicing officer at PennyMac, agrees.

“Assumptions typically involve additional complexities,” Bailey explains. “Overall understanding and knowledge of assumptions is not as widespread as conventional loans.”

Additionally, because conventional loans are more common, the process leverages more advanced technologies. However, handling assumptions often requires a more hands-on approach like manual underwriting, mostly because there are no automated underwriting systems available to support them.

Still, whatever the reasons slowing down assumable loans, McDonough thinks they’re no excuse.

“It’s not right that assumable options—which are part of the National Housing Act, which created the FHA in 1934—should in any way be made difficult [for] buyers,” he says.

As for what needs to change, raising allowable fees for assumable loans above $300 could help. Pressure from on high could also make a difference.

“The VA came out with a circular two months ago telling all VA lenders and servicers to smarten up and start not obstructing these assumptions,” McDonough says. “The FHA has to do the same thing. I think these servicers need to put a little bit of their best and brightest on getting these done.”

Bailey adds that PennyMac has “more than doubled the dedicated assumption resources to meet higher demand. This resulted in growing our completed assumptions more than six times year over year from 2022 to 2023. We will continue to increase our resources to support the rising popularity.”

But until all corners of the lending world embrace helping assumable loan borrowers, McDonough says jokingly, “It will allow Jerry and me to have a lucrative venture for a while.”

Assume Loans’ fees start at $2,950 but can go higher depending on how involved it needs to be in the assumption process, says Devlin.

While Ricard and Lucchese were initially not sure they could afford the extra cost, in the end, Ricards says it was totally worth it.

“We would not have gotten this house without Mark,” he says.

Photo courtesy of Grace Lucchese

‘You have to fight for it, but it’s so worth it’

With McDonough’s help, Ricard and Lucchese succeeded in assuming their seller’s loan and closed on their home on Jan. 16 for $422,500. Their house and their loan are the envy of all who hear their story.

“Whenever we tell people how much our assumable loan saves us, their faces fall, and they’re like, ‘I need to find this,’” Lucchese says.

Grace Lucchese

Their advice to others?

“I would absolutely recommend assumable loans, but I think people need to be wary of who they’re working with,” Ricard says.

“We have a saying that ‘nothing is ever easy for us,’” Lucchese says. “So be ready to fight for it. It’s such a shame it’s so hard to buy a house. But now there’s a loophole—and if you find it, you’ve just got to take a risk and do it.”

Grace Lucchese

Realtor.com has recently added an “assumable loan” search filter so shoppers can easily find these properties. Below is a list of cities with the highest percentage of listings that mention “assumable loan.”

Honolulu, HI

Percentage of listings: 3.3%

2857 Von Hamm Pl

Price: $1,589,000

Realtor.com

New Orleans, LA

Percentage of listings: 2.8%

3174 Potomac St

Price:$169,500

Realtor.com

Ogden, UT

Percentage of listings: 1.6%

3151 N Holiday Dr

Price: $489,000

Realtor.com

Tucson, AZ

Percentage of listings: 1.4%

9628 E Paseo Del Tornasol

Price: $305,000

Realtor.com

Augusta, GA

Percentage of listings: 1.3%

3804 Retreat Ct

Price: $225,000

Realtor.com

San Antonio, TX

Percentage of listings: 1.21%

237 Vance St

Price: $989,000

Realtor.com

Virginia Beach, VA

Percentage of listings: 1.16%

4173 Charity Neck Rd

Price: $970,000

Realtor.com

Salt Lake City, UT

Percentage of listings: 1.08%

5311 S Clover Meadow Dr W

Price: $565,900

Realtor.com

Jacksonville, FL

Percentage of listings: 1%

3483 Wentworth Cir W

Price: $375,000

Realtor.com

Tampa, FL

Percentage of listings: 0.97%

4607 Limerick Dr

Price: $245,000

Realtor.com

The post ‘We Bought Our Home With a 2.6% Assumable Mortgage’—Why It Was Hard To Get, but Worth the Fight appeared first on Real Estate News & Insights | realtor.com®.