National Archives/Interim Archives/Getty Images

The Value Gap is a MarketWatch interview series about confronting inequality that features business leaders, academics, policy makers and activists.

For much of the 20th century, people of color in the U.S.—particularly Black Americans—were limited in how they could buy, sell or occupy property. Those restrictions on homeownership stemmed in large part from private actors such as developers and real-estate agents, predating discriminatory public policies, a new book argues.

In his book “Patchwork Apartheid: Private Restriction, Racial Segregation and Urban Inequality,” author Colin Gordon analyzed historical property records in five Midwestern counties and found that racial restrictions on private property were prevalent even before zoning and building codes were put in place to shut out people of color from homeownership opportunities, and before federal redlining took hold.

“The origins of segregation live much earlier” than federal redlining, Gordon, a history professor at the University of Iowa, told MarketWatch. “It’s mostly the work of private interests using these private restrictions and other devices.”

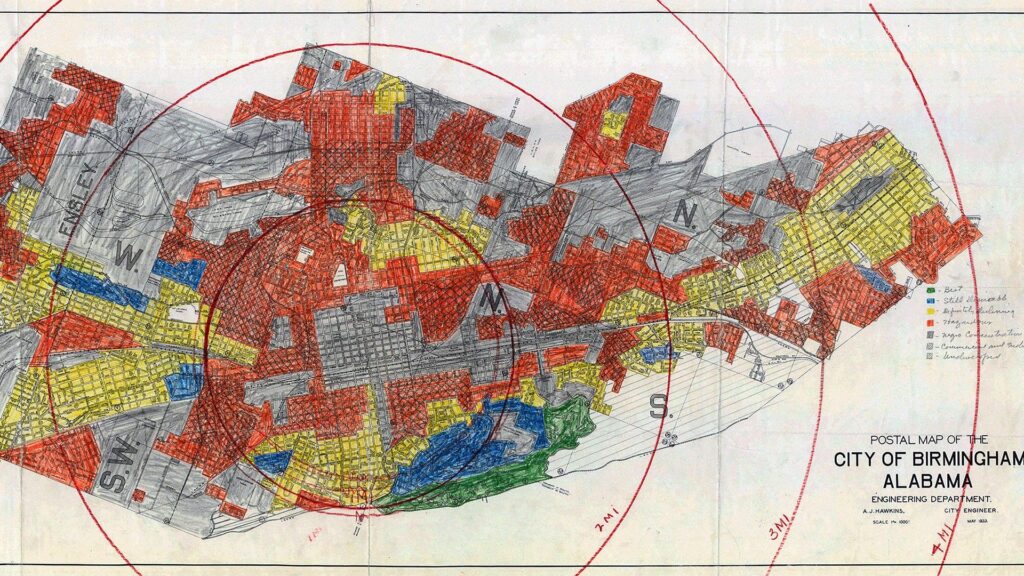

Redlining refers to color-coded maps created in the 1930s that deemed predominantly Black and immigrant neighborhoods too risky to receive government-backed home loans, outlining them in red. The discriminatory practice was used to systematically deny Black people access to mortgages.

Even as the newly established Federal Housing Administration refused to insure mortgages in Black neighborhoods, it was mass-producing subdivisions for white people, as explained by Richard Rothstein’s “The Color of Law.”

In 1968, the Fair Housing Act banned racially motivated redlining. But its effects still reverberate decades later, and studies show modern-day redlining persists. The white homeownership rate far outstrips the Black homeownership rate: Nearly 73% of white Americans owned their home in 2021, compared with 44% of Black Americans.

Gordon’s book details how private actors laid a foundation for redlining to thrive. The documents he pored over reveal how racial segregation played out in neighborhoods and suburbs, and how white developers, real-estate agents and others in the real-estate industry constructed barriers to Black homeownership.

Housing developers and real-estate agents would spell out explicit racial restrictions that would lead to certain neighborhoods being characterized as white and therefore more desirable, compared with neighborhoods considered Black and undesirable, Gordon said. Policies at the state and federal level then helped sustain these private practices, he wrote, and served to protect white-only neighborhoods.

The National Association of Realtors issued a formal apology in 2020 for its past policies that supported redlining, racial covenants and other racist practices, calling them “a betrayal of our commitment to fairness and equality.” Real-estate trade groups in cities including Chicago, Atlanta and St. Louis have released similar statements.

This interview has been edited for length and clarity.

MarketWatch: Why write this book now?

Gordon: I’m a professor of history at the University of Iowa, and my work is mostly on the history of public policy. But a number of years ago, I got very interested in the sort of mechanisms and origins of segregation in American cities.

That led to a couple of books on St. Louis, and then I pivot to this deep dive into private racial restrictions because it was a newly available dataset.

‘When the federal government comes along to try and save housing markets in the Great Depression, they don’t challenge what the private market has done—but they don’t create it, either.’

Recorders are just starting to digitize this history, and so you can just dig into it. And it turned out to be a good pandemic project, because I just lived in the basement of the recorder’s office and did the research.

I think that we’ve sort of gone overboard in blaming federal redlining for segregation. And I think the origins of segregation live much earlier. It’s mostly the work of private interests using these private restrictions and other devices. And when the federal government comes along to try and save housing markets in the Great Depression, they don’t challenge what the private market has done—but they don’t create it, either.

In some ways, it’s not surprising, because federal economic policy often just defers to private interests, such as asking what we need to do to stabilize your industry. And I think that’s what they did in this case.

MarketWatch: Who are these private actors and what were their interests?

Gordon: Most private restrictions are put in place by developers. So when subdivision development increases fairly dramatically in scope and scale in the 1920s, and it starts with the kind of larger-scale enterprise, those big community builders are the ones that basically establish what are sort of private building and zoning codes, because they come before most municipalities really have any systematic building zoning codes. So they’re the main culpable party.

But in places like St. Louis or Waterloo, Iowa, in older neighborhoods, where [they were] facing an influx of African-American residents, then it’s the real-estate agents who are doing most of the work—often going door to door to try and get people to sign retroactive agreements to cover neighborhoods.

So by the mid-1920s, you get a lot of other cities, even smaller cities that are just emulating what’s going on in the big cities, [and it] becomes just a sort of common business practice.

The town I live in, Iowa City … it’s a relatively small setting, and has virtually a negligible African-American population. But beginning in the early 1920s, real-estate agents were [excluding African Americans from buying homes] all the time. Not because there was any threat posed in a neighborhood or in the city, but it just was business practice. This is what you do to protect property.

MarketWatch: Can you give us some examples of what these developers and agents did to segregate neighborhoods?

Gordon: There are two main kinds of restrictions. The prominent one, which is the one put on by developers, was close to what we would now consider [a homeowners association] set of rules—so more detailed than zoning or building codes, and often very specific to certain settings. … It’s usually a laundry list of things that have to do with the building and [are] placed into your house.

So, you know, what your roof had to be made [of], how many stories, how far back from the street, whether the garage can be attached, that sort of thing. And then there were a series of prohibitions against nuisance uses of property. … But the most prominent nuisance listed was occupance by someone not only of the Caucasian race. And that’s added to the list of nuisance uses that would destroy the value of property. So that was the first major mechanism.

The second one was in neighborhoods where the houses were already built and there seemed to be a threat of African Americans moving in—then these restrictions were put together by petition. And real-estate [agents] would go door to door and try to get people to sign. … They would get 40 or 80 property owners on both sides of the street for a couple of blocks to sign, and then they’d go file it at the recorder’s office as a restriction binding on all the houses on that street.

One of the things I argue in the book is [that] the core idea that African-American occupancy is a nuisance that destroys property value is an invented idea. But once you invent it and act upon it, it becomes real, right? And so if you think your property values are going to decline, you try and get out ahead of everybody else.

You end up with these waves of white flight and what looks a little bit like blockbusting, because people overreact to it. And it’s not about class. I mean, this is aimed at African Americans of all economic stations.

In the city of St. Louis, for example, which had a pretty prominent African-American population as early as the turn of the century, there’s an African-American hospital, the first African-American high school. … So these are schoolteachers and dentists and surgeons, and they’re just as affected by these restrictions.

MarketWatch: What was the most surprising finding from your research?

Gordon: What surprised me the most was that we’ve always known, because of legal challenges, of these documents. But until my colleagues in Minnesota did the Mapping Prejudice project, which was a first big dig into digitization, no one knew the extent.

Minneapolis is an interesting case. About 25% of the residential base in 1950 had these restrictions on them. And when [the researchers] finished their work, we thought, “Wow, that’s a lot.”

When I [analyzed] St. Louis County, which is the suburban county immediately west of the city of St. Louis, 80% of their 1950 residential base had a racial restriction on almost everything. Virtually everything that was built between 1920 and 1950 was restricted. The only areas that weren’t restricted were some of the older developments.

So I think the most surprising thing … to me was just how ubiquitous these were, by the end of World War II, particularly in fast-growing Midwestern cities where a lot of the housing was built during this year in infrastructure.

MarketWatch: So where did African Americans live in those days in St. Louis?

Gordon: St. Louis would be a good example. These [racial] restrictions are everywhere in the suburbs, right to the city, and there’s a sort of ring of [suburbs] that [were] done by petition to the south of the predominant African-American neighborhood. So what that means is during both phases of the Great Migration … up until these were no longer enforceable, African Americans are moving into denser and denser housing, in the few neighborhoods.

The city accommodates this by rezoning African-American neighborhoods for multifamily housing, so that the houses there can be carved up into flats.

So these often go hand in hand: You get [this] private protection of single-family homes; they’re for whites only. But that doesn’t stop African Americans from moving to St. Louis. It just determines where in the city they can go.

‘If your parents and your grandparents were shut out by discriminatory mortgage financing or by this kind of private restriction, it affects you; it’s going to affect your kids as well. It just sort of spills forward through the generations.’

MarketWatch: So America’s strong cultural norm of owning a single-family home has some racist underpinnings?

Gordon: I think it is a very powerful engine of inequality, especially given the trajectory of housing prices over the last 50 years. As I argued in the book, it is one of the long shadows of this era of private restriction—because even though it’s unenforceable in 1948, and illegal in 1968, it created a racial wealth gap that is not going away.

Most people’s wealth is home equity, and most people get into the housing market with help from their parents. And if your parents and your grandparents were shut out by discriminatory mortgage financing or by this kind of private restriction, it affects you; it’s going to affect your kids as well. It just sort of spills forward through the generations.

MarketWatch: Did any developers or agents go against the grain and try to sell to people of color amid restrictions and segregation?

Gordon: Here’s a small but interesting story. One of the biggest developers in St. Louis was very active in the Catholic church and very much a racial liberal for his time, and he marched at Selma. He was big in the city’s biracial civil-rights movement.

But every subdivision he built before 1950 had a racial exclusion. And in his private correspondence, he’s a little bit tortured by this, and you see him saying, “I have to do what everyone else was doing or, you know, my property won’t be worth as much when people won’t want to move to it.”

What he does at one point is, he goes out and he builds a community just for African Americans. … And he flips the script, and says whites are not allowed to live here. And it’s sort of a flop. I mean, people are a little bit offended by the sort of separate-but-equal logic of it … and the housing he builds in that subdivision is pretty cheap.

I think his thought process is that, “You know, I’m doing this because I have to do it as business practice. I don’t really think that it’s a nice thing to do. So maybe on the side, I’ll build some houses that are just for Black people.”

MarketWatch, the place where you can find the latest stock market, financial and business news. Cryptocurrency is trending now, get the latest info on Bitcoin, Ethereum, and XRP.

The post How Real-Estate Agents and Private Developers Created the Blueprint for Redlining, According to One Historian appeared first on Real Estate News & Insights | realtor.com®.