DenisTangneyJr/Getty Images

While millennials are seeking out starter homes and baby boomers are hoping to downsize, Generation Z is trying to elbow its way into the frenzied housing market marked by record-low mortgage rates and all-time-high home prices.

These predominantly first-time buyers are purchasing property mostly in the nation’s more affordable metropolitan areas that boast much more reasonable home prices than the high-priced coasts, according to a recent LendingTree study. This group, born after 1996, is stereotypically more frugal and better with money than prior generations. It makes up a little less than 10% of potential home buyers in the country’s biggest metropolitan areas.

The online financial services marketplace looked at mortgage purchase requests by folks aged 18 to 23 from Jan. 1 through Oct. 1. The study included requests made only in the 50 largest metropolitan areas. (Metros include the main city and surrounding suburbs, small towns, and other urban areas.)

“Gen Z buyers are young, but that’s not stopping some from getting into or trying to get into the housing market,” says realtor.com® Chief Economist Danielle Hale. “Areas where Gen Z buyers are finding success are generally affordable, which makes sense since younger buyers tend to have a harder time scraping together a down payment and also tend to have lower incomes.”

The greatest percentage of Gen Z mortgage requests were in Salt Lake City. They made up nearly 8.5% of potential buyers. Salt Lake City, a burgeoning tech hub set at the edge of the Rocky Mountains, boasted the highest median home list price of $482,550—well over the national median of $350,000 in September, according to realtor.com data. That’s unlike most of the other spots on the list, which skewed heavily toward the more affordable Midwest.

However Salt Lake City, founded by Mormons, is still significantly cheaper than other big West Coast cities like San Francisco, Los Angeles, and Denver. They have median home prices of $1,03,750, $995,050, and $522,050 respectively.

The average age of these buyers was just 21.5—barely old enough to legally drink. They had an average credit score of 672, had an average down payment of nearly $33,000, and requested mortgages of an average $244,365.

We see a lot of Gen Z buyers in Salt Lake City in part because that’s where Gen Zers are.

“Salt Lake City’s younger population means we see the younger generation well-represented,” says Hale.

After Salt Lake City, members of Gen Z submitted the most mortgage requests in Oklahoma City, at 8.01%, and Indianapolis, at 7.74%. Both have median home prices below $300,000. Prospective Gen Z borrowers requested mortgages of $141, 396 in Oklahoma City, where the median list price is $286,700, and $146,349 in Indianapolis, which has a median price tag of $286,200.

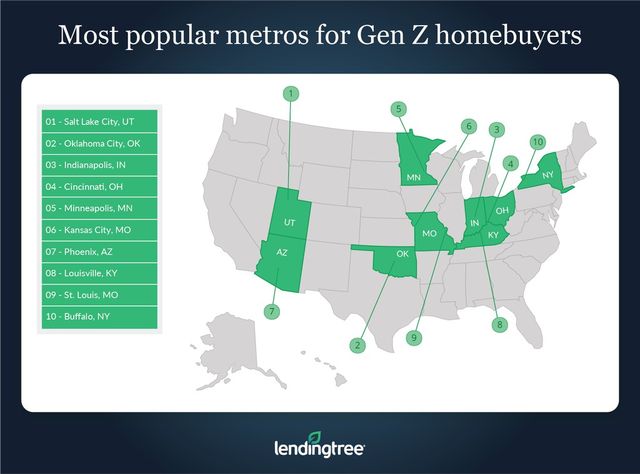

The top 10 metros where Gen Z is requesting the most mortgages:

- Salt Lake City, UT, with a median home list price of $482,550

- Oklahoma City, OK, at $286,700

- Indianapolis, IN, at $286,200

- Cincinnati, OH, at $318,050

- Minneapolis, MN, at $354,450

- Kansas City, MO, at $339,500

- Phoenix, AZ, at $413,500

- Louisville, KY, at $267,500

- St. Louis, MO, at $250,050

- Buffalo, NY, at $229,950

Where is Generation Z requesting the fewest mortgages?

These youngsters sought out the fewest mortgages in the most expensive real estate markets. That makes sense as most of these folks, the oldest of whom would be about 24, are just embarking on their careers.

They submitted the fewest mortgage requests in San Francisco, at 2.19%. Silicon Valley’s San Jose was next, with just 2.98% of requests, followed by New York City, at 3.3%.

Median prices in the metros were $1,03,750, $1,199,450, and $625,000 respectively. New York City may look like a bargain compared with the California cities, but it’s worth noting that the New York City metro area is the largest in the nation. It encompasses much less expensive swaths of upstate New York, Pennsylvania, Connecticut, and New Jersey.

In San Francisco, average Gen Z buyers were 21.6 years old, had a 710 credit score, and had come up with $124,530 down payments. They requested an average mortgage amount of $575,723 due to the higher prices.

Provided by Lending Tree

The post Kids These Days! Gen Z Is Buying Up Homes in These 10 Cities appeared first on Real Estate News & Insights | realtor.com®.