Getty Images

When the Federal Reserve raised interest rates at its March 22 meeting, many housing market observers presumed that rates for home loans would soon follow this upward trajectory. Yet despite these expectations, mortgage rates defied the odds and ticked down, for the third straight week.

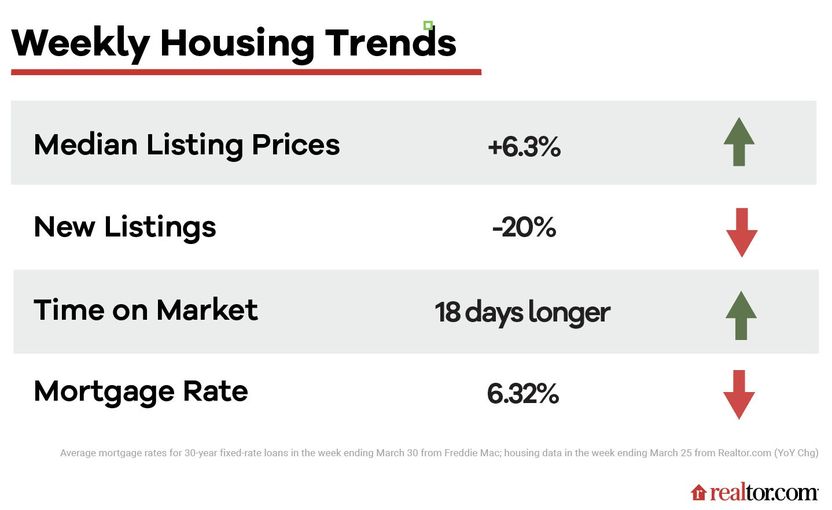

According to Freddie Mac, rates for a 30-year fixed-rate mortgage have slid from 6.60% in mid March to 6.32% for the week ending March 30.

It’s a solid reminder that while the Fed might influence mortgage rates, it does not control them. It’s also a small window of opportunity for homebuyers who act fast to lock in lower rates that could help put the costs of home ownership within easier reach.

But “fast” will be the key word here, since the mortgage market has become more untethered and unpredictable than ever.

“The course of mortgage rates is likely to be bumpy,” notes Realtor.com® Chief Economist Danielle Hale in her weekly analysis.

All in all, the spring housing market is shaping up to be a rough ride that will no doubt impact how many homebuyers and sellers can stomach the ups and downs.

As Hale explains, “Looking ahead, mortgage rates will play a significant role in the volume of activity we see in the housing market this spring.”

In this latest installment of our column “How’s the Housing Market This Week?“, we’ll decipher what this all means for homebuyers and sellers who are trying to decide whether to dive into these choppy waters.

Why homebuyers are still struggling

For homebuyers trying to navigate today’s rocky housing market, mortgage rates are just one of many problems on their plate.

Another issue is that home prices remain stubbornly high. Listings for the week ending March 25 were 6.3% more expensive than this same week last year. And with March’s median asking price hovering at $424,500, that’s still “higher than all but the priciest six months of 2022,” Hale points out.

The good news is that prices are growing at a slow, single-digit rate, and those growth rates are likely to continue tapering and may even flip negative this summer. Still, this probably isn’t happening fast enough for most house hunters.

Another problem homebuyers are grappling with is the woeful lack of new homes. For the week ending March 25, 20% fewer new listings hit the market verses this same week a year earlier. Incredibly, the number of new listings was nearly on par with the low touched way back in April 2020, when much of the world was in lockdown amid the first waves of the COVID-19 pandemic.

With fewer newly-listed homes for sale in the most recent week, and at higher prices, buyers are largely unhappy with their prospects. Home purchase sentiment declined in February and many have simply dropped out of the market, leaving the few who remain with a dubious advantage.

“The market is less competitive than it has been the prior two years,” says Hale, “but in large part because higher home prices and mortgage rates have made it difficult for many to navigate the high costs.”

Why the housing market slowdown continues

Even though there are fewer new listings, there’s a whopping 57% more homes for sale. But many of those listings are a lot older. Homes for sale are spending, on average, 18 more days on the market than they would have a year earlier.

“What I am seeing is homes sitting on the market longer,” says Denise Supplee, a real estate investment educator at SparkRental and a real estate agent in the Philadelphia area. “Bidding wars are not as common. I personally think that the interest rates are scaring purchasers, both newbies and the savvy purchasers. I have had one buyer decide to hold off on selling their home to buy another.”

As for what she thinks is next for her market, Supplee says, “I do believe we will see a slowdown, and the heavily favored seller’s market tilt towards the buyer.”

Meanwhile, may will keep a close eye on the Fed and what its moves signal for the economy at large.

“Investors will evaluate whether each new piece of data signals that the long-awaited end of monetary tightening, that the Fed acknowledged is now closer on the horizon, is finally in the rearview,” says Hale. “Until then, equity-rich homeowners are likely to continue to have an edge.”

The post Did Mortgage Rates Just Go Rogue? Why Today’s ‘Bumpy’ Housing Market Just Got Wilder appeared first on Real Estate News & Insights | realtor.com®.