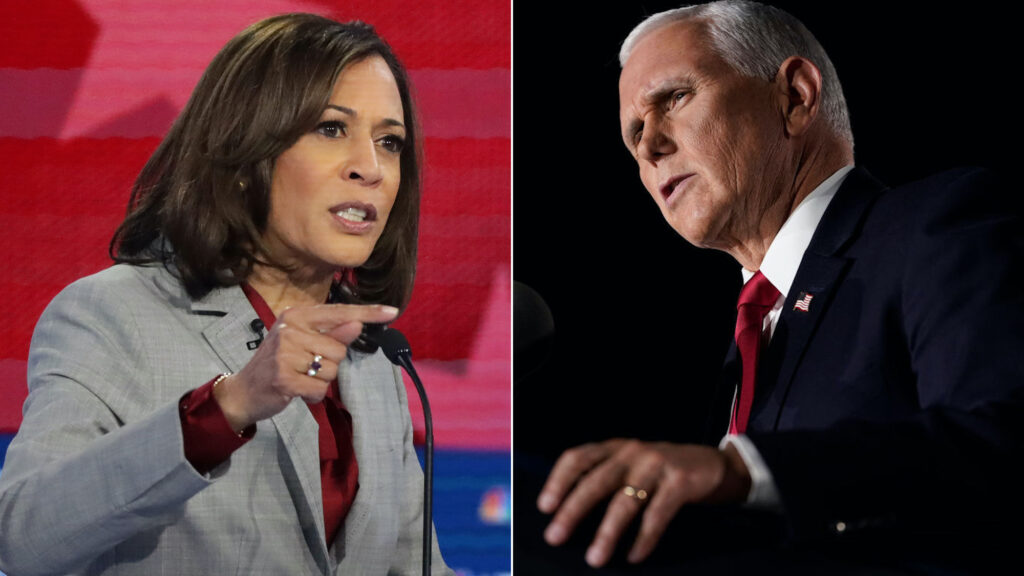

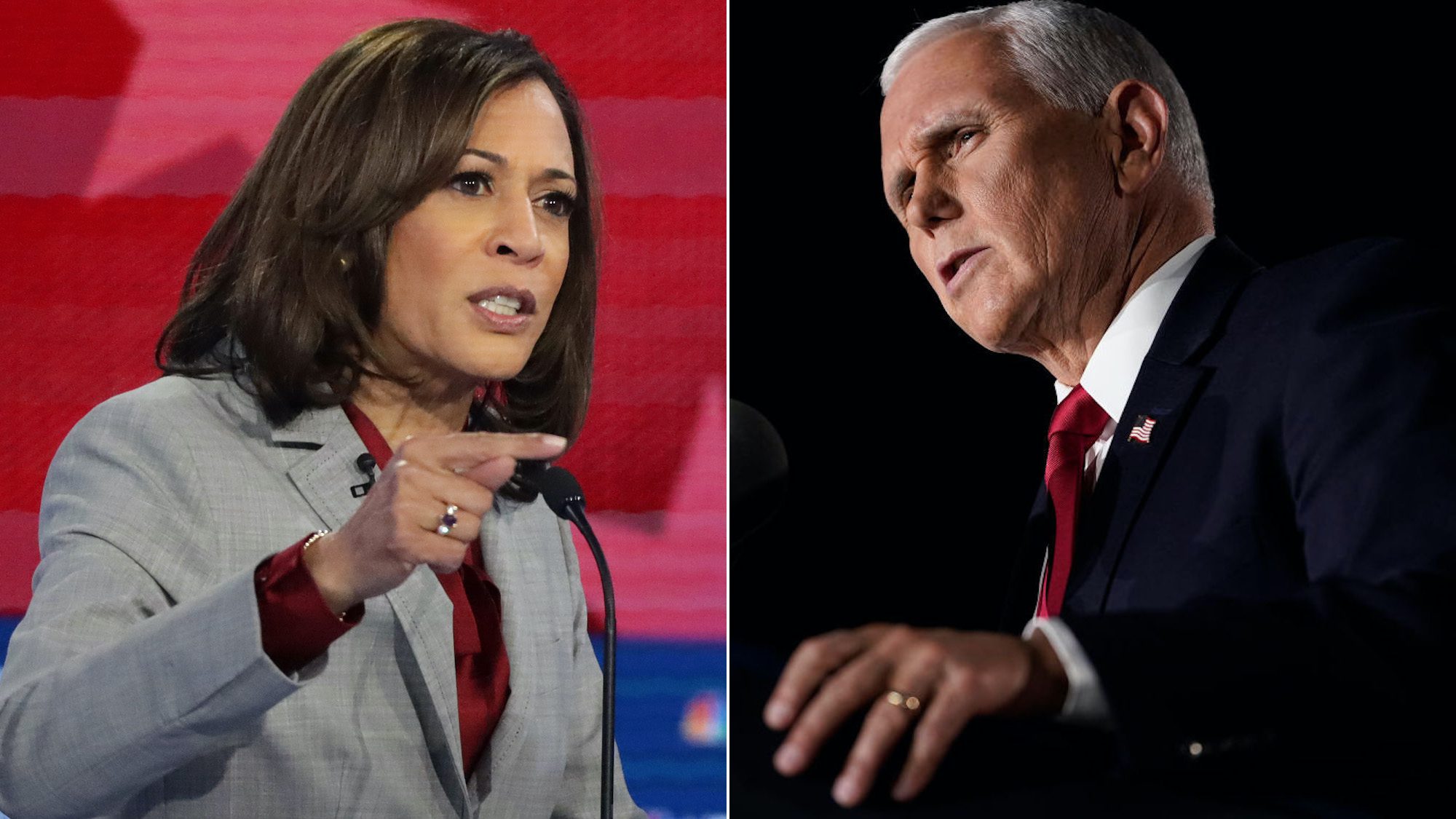

Alex Wong/Getty Images | Drew Angerer/Getty Images

While the vice presidential debate hasn’t typically been considered must-see TV, the events of the past few days have greatly raised the stakes. President Donald Trump‘s COVID-19 diagnosis, along with the age of both Trump and his Democratic contender, former Vice President Joe Biden, has unearthed an uncomfortable truth. The VP on the ticket could well ascend to the presidency.

Housing isn’t likely to come up in Wednesday’s debate, which will pit Vice President Mike Pence against Sen. Kamala Harris. The issue will likely be crowded out by other hot-button concerns, such as the handling of the pandemic (and exactly how many feet each politician is stationed from the other), the faltering economy, and law and order as racial injustice protests continue across the nation.

But that doesn’t mean that housing shouldn’t be top of mind. The country is in the throes of a historic housing shortage that is pushing up prices to never-before-seen highs. Millions of renters are on the brink of evictions. And the housing affordability crisis is making it more difficult for many to achieve the American dream of homeownership.

So how do the vice presidential candidates stack up when it comes to housing?

“Their positions generally line up with their respective party lines,” says realtor.com® Senior Economist George Ratiu. “[Pence] is very much more of a fiscally conservative proponent of property rights. [Harris] is a lot more focused on the affordability issues, which are particularly pressing in the current environment.”

___

Watch: What the Latest Jobs Numbers Say About the Housing Market

___

What is Vice President Mike Pence’s housing track record?

Pence never released any grand housing plans during his tenure as governor of Indiana or when he served in Congress.

“It wasn’t a major issue [for him] in Congress or as governor,” says Michael Tanner, a senior fellow at the Cato Institute, a libertarian think tank based in Washington, DC.

But there are a few clues to be gleaned from his conservative views and years in office. Generally, the vice president has favored a smaller government footprint when it comes to the housing market.

Pence has been a loyal supporter of Trump’s housing policies. Trump has capped mortgage deductions and property taxes, advocated for privatizing Fannie Mae and Freddie Mac, and did away with a rule that would have required many suburbs to become more racially diverse.

As the 50th governor of Indiana, Pence signed a law in 2015 letting banks off the hook for the maintenance and upkeep of the foreclosed properties on their books. The law also made it easier for properties to be declared vacant to speed up their sales.

While serving in the U.S. House of Representatives, from 2001 to 2013, he also amassed a long track record of supporting and opposing various housing-related bills.

As a congressman, Pence voted in 2010 against using Troubled Asset Relief Program money to provide legal services to those facing foreclosures during the Great Recession. The same year he opposed reauthorizing the National Flood Insurance Program, which uses tax dollars to subsidize flood insurance policies of homeowners living in flood-prone areas.

He also voted against the Dodd-Frank Wall Street Reform and Consumer Protection Act introduced in the wake of the housing crash. The law basically did away with subprime mortgages and created stricter standards for who was eligible to receive the home loans. It also required lenders to better verify that someone’s financial information was accurate. The law also created the Consumer Financial Protection Bureau, which helps borrowers with mortgage issues.

He was against allowing bankruptcy judges more power in restructuring the terms of mortgages on primary residences. He opposed a bill that standardized licensing requirements for mortgage lenders and required lenders to spell out the maximum costs that borrowers could be charged with on a loan, to prevent subprime and ballooning mortgages. He also voted against housing foreclosure assistance programs and expanding mortgage insurance programs.

However, Pence was in favor of extending a home buyer tax credit for first-time buyers of 10% of the purchase price of a home up to $8,000. It also established a credit up to $3,250 for homeowners who have lived in their primary residence for five consecutive years. The amount was doubled for couples.

What would Sen. Kamala Harris mean for housing?

Harris, a former San Francisco and then state attorney general, has focused more on housing. Her plans have been designed to provide more government assistance to lower-income and marginalized Americans and increase housing affordability.

As a presidential candidate, she debuted a $100 billion proposal to help more Black Americans become homeowners. The aim is to help to close the racial wealth gap in the nation, as most Americans build wealth through homeownership.

The plan would enable residents of historically redlined communities to apply for federal grants of up to $25,000 to be used for down payments or closing costs. Redlined neighborhoods are where lenders refused to make mortgages to people of color until the practice was outlawed. Her team said this could provide assistance for up to 4 million households.

The plan would also strengthen and enforce anti-discrimination laws in renting and buying homes and receiving mortgages.

This summer she introduced legislation in the Senate to ban evictions and foreclosures for a year. The bill would give renters up to a year and a half to pay their landlords their owed rent. The bill would also help tenants fighting eviction receive legal help and limit the amount of damage the missed rent payments would do to their credit.

“Given the slow economic recovery combined with a housing affordability crisis and high unemployment, a housing plan which addresses the needs of lower-income Americans is crucial,” says Ratiu.

She also attempted to create refundable tax credits for households whose housing costs were greater than 30% of their income. This would apply to rent and utilities.

“It essentially says we’re going to give a lot of money to people to pay their rent. … But it doesn’t actually bring down the high cost of housing,” says Cato’s Tanner. “Subsidies ratchet up demand without dealing with supply, which simply makes housing more expensive. You’ve got to increase supply if you’re going to bring down costs overall.”

Last November, Harris sponsored a bill to invest more than $100 billion in affordable housing. It included putting $70 billion into public housing and $6 billion for housing for the elderly and disabled. An additional $10 billion would be earmarked for doing away with zoning or other regulations making it more difficult to put up affordable housing.

The post Mike Pence vs. Kamala Harris: What Each VP Candidate Could Mean for Housing appeared first on Real Estate News & Insights | realtor.com®.