Design by Realtor.com / Getty Images (3)

Home shoppers, especially first-time buyers and those with tight budgets, have been through the wringer lately. They’ve struggled with skyrocketing prices and historically low inventory. Inflation and rising rents have cut deeply into their savings accounts, and, lately, mortgage rates have hit 20-year highs.

Now, add one more searing pain point to the list: Bigger-than-ever down payments are expected in many areas before sellers will even consider an offer. Even in lower-priced markets, down payments have generally gone up in the post-COVID-19 housing era.

It’s exacerbating one of the traditionally most challenging parts of homebuying: saving up for the cash down payment. And it’s enough to dissuade some cash-strapped buyers from buying altogether.

While putting down 20% of the purchase price is the gold standard, in many highly competitive real estate markets, buyers are now expected to contribute significantly more. Yet—in other parts of the country, buyers can get away with kicking in just a fraction of that.

“Sellers look at the smaller down payment as coming from a riskier buyer, with less certainty that the mortgage will be approved or close on time,” says Rob Chrane, CEO of DownPayment Resource. The company helps homebuyers find information about down payment assistance. “It got really extreme before the market started cooling down.”

As home prices hit new heights over the past few years, down payments in the tightest markets went up and up—a combination of sellers’ demands and buyers’ tactics to beat out the competition. For single-family home sales, the average down payment jumped to a high of more than 14% of the purchase price this year. That’s up from just above 11% in 2019.

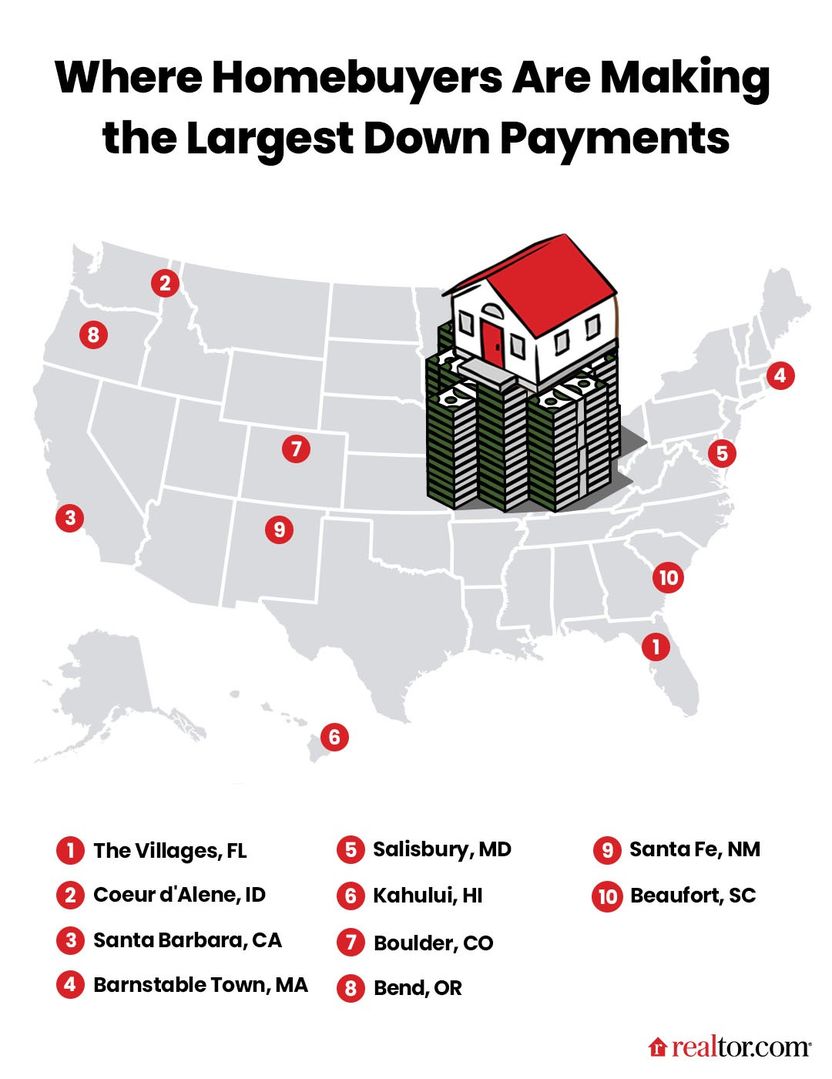

To figure out where buyers are putting the most and least down on their home purchases, the Realtor.com® data team pored through September home sales in the 300 largest metropolitan areas using mortgage data from Optimal Blue. We limited our rankings to just one metro per state to ensure geographic diversity. (Metros include the main city and surrounding towns, suburbs, and smaller urban areas.)

So where are buyers plunking down the most—and least—amount of cash?

1. The Villages, FL

Average down payment: 30.2%

Median home purchase price: $375,000*

2. Coeur d’Alene, ID

Average down payment: 27.9%

Median home purchase price: $530,000

3. Santa Barbara, CA

Average down payment: 26.4%

Median home purchase price: $800,000

4. Barnstable, MA

Average down payment: 26.0%

Median home purchase price: $624,000

5. Salisbury, MD

Average down payment: 24.0%

Median home purchase price: $409,990

6. Maui, HI

Average down payment: 24.0%

Median home purchase price: $900,000

7. Boulder, CO

Average down payment: 23.9%

Median home purchase price: $683,150

8. Bend, OR

Average down payment: 23.9%

Median home purchase price: $545,000

9. Santa Fe, NM

Average down payment: 23.8%

Median home purchase price: $510,000

10. Hilton Head, SC

Average down payment: 23.7%

Median home purchase price: $425,000

!function(){“use strict”;window.addEventListener(“message”,(function(e){if(void 0!==e.data[“datawrapper-height”]){var t=document.querySelectorAll(“iframe”);for(var a in e.data[“datawrapper-height”])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

Big down payments indicate high-demand markets more than anything else

So where does it take the biggest chunks of cash to buy a home? As you’d expect, they are mostly the places with either larger-than-median price tags or higher-than-average demand from buyers.

Take Santa Barbara (No. 3), for example. The coastal city in central California has long been one of the most popular destinations for well-heeled homebuyers. Even with a sizable median sale price—$800,000 in September—buyers are sweetening their offers with a higher down payment, a hefty median of 26.4% of the purchase price.

But some of these real estate markets might come as more of a surprise. Bend, OR (No. 8), is a small city straddling the Deschutes River, about three hours southeast of Portland. It offers residents an abundance of outdoor activities and natural beauty, but it’s hardly a destination that one might aspire to in the way that retirement haven The Villages, FL (No. 1), or tropical paradise Maui, HI (No. 6), are for many buyers.

High demand is the market force that every expert agrees is most responsible for large down payments. During the steep housing acceleration of the past couple of years, “bigger down payments [became] very commonplace, especially when things got competitive,” says Bianca Griffith, a real estate agent with Re/Max of Boulder, CO. In the Colorado city (No. 7), new construction is limited, so buyers are competing over a very small selection of properties.

Vacation destinations and retirement hot spots dominate the biggest down payments

The biggest down payments are also the norm for areas that have become holiday getaways, second-home havens, and retirement destinations.

Down payments for second homes have historically been much higher than for primary residences—well above 20% for years. But even those down payments have grown, averaging above 26% since June this year.

Increasingly popular beach areas such as the Atlantic Ocean perches of Barnstable, MA—better known as the Cape Cod metro area—and golfing mecca Hilton Head, SC, require increasingly steep entry fees for homebuyers.

The entire Cape Cod area used to be a vacation town for all sorts of people who lived in the Northeast, according to Doug Payson, a real estate agent with Kinlin Grover/Compass Real Estate, in Barnstable.

“We had people from a large variety of income levels,” says Payson, who’s lived and worked in Barnstable for decades. “Now, the buyers are increasingly affluent.”

Other places on the list are dotted across the Mountain West, attracting skiers, hikers, and anglers. These locations include Boulder, Coeur d’Alene, ID (No. 2), and Santa Fe, NM (No. 9).

They are where some of the most desirable and limited real estate is found. Another thing these places have in common? A lot of them are also where people head to spend their retirement.

Geralyn Vilar, a Realtor® with Future Home Realty in The Villages, says she sees many more retirees making all-cash purchases in recent years.

“They sell houses up North that they’ve had for years. They take that equity and come down here, and they can buy outright,” Vilar adds.

Top-dollar down payments are new in several places

Not all of the places on the highest end of the down payment scale have always required such a hefty cash outlay.

In the mid-2010s, a home purchase in Hilton Head, SC, came with a down payment that looked more like the average, somewhere around 11% or 12%. But in recent years, the average down payment size has ballooned to more than 20%. Coeur d’Alene and Bend are other cities where down payment size has grown, showing signs of growing demand in both.

Even in The Villages, down payments used to be lower, around 14%, before shooting up in the past several years, to above 26%.

!function(){“use strict”;window.addEventListener(“message”,(function(e){if(void 0!==e.data[“datawrapper-height”]){var t=document.querySelectorAll(“iframe”);for(var a in e.data[“datawrapper-height”])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

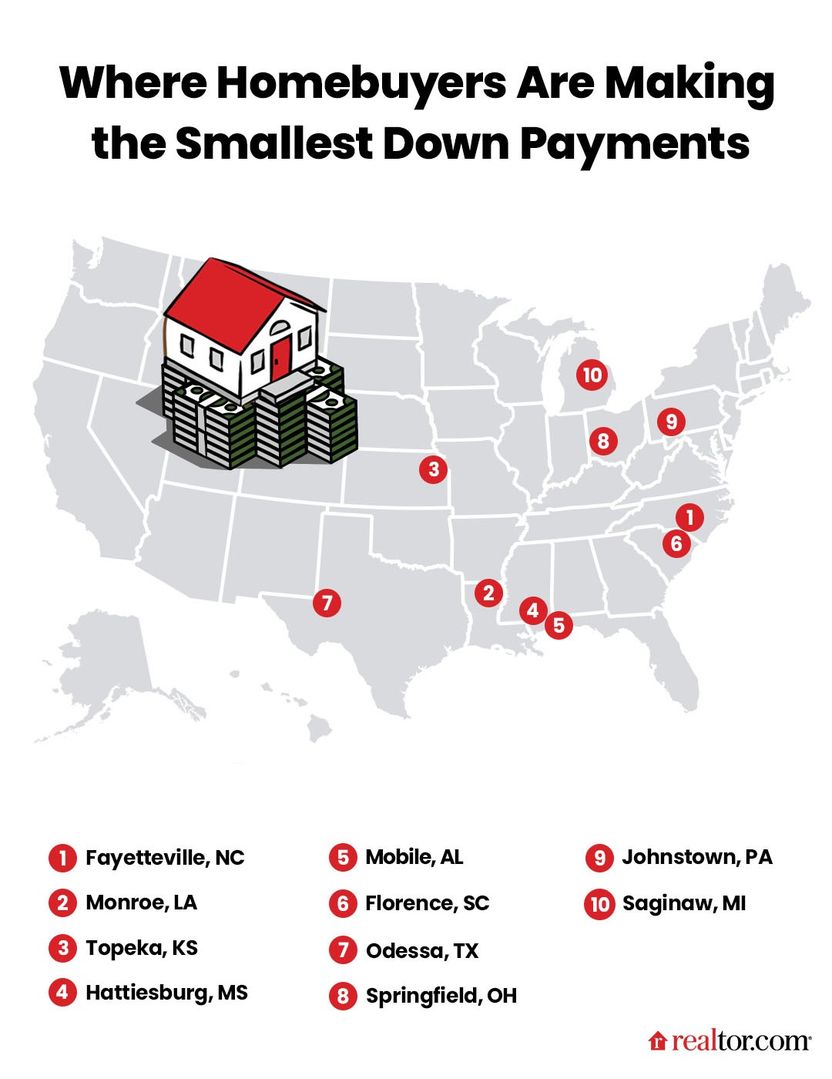

Metro areas with the smallest down payments

1. Fayetteville, NC

Average down payment: 4.3%

Median home purchase price: $239,900

2. Monroe, LA

Average down payment: 4.7%

Median home purchase price: $192,000

3. Topeka, KS

Average down payment: 7.1%

Median home purchase price: $159,777

4. Hattiesburg, MS

Average down payment: 7.3%

Median home purchase price: $220,000

5. Mobile, AL

Average down payment: 7.6%

Median home purchase price: $249,000

6. Florence, SC

Average down payment: 8.0%

Median home purchase price: $237,000

7. Odessa, TX

Average down payment: 8.1%

Median home purchase price: $275,000

8. Springfield, OH

Average down payment: 8.4%

Median home purchase price: $157,000

9. Johnstown, PA

Average down payment: 8.6%

Median home purchase price: $145,000

10. Saginaw, MI

Average down payment: 8.7%

Median home purchase price: $160,000

Buyers are making the smallest down payments in the South and Rust Belt

For those home shoppers without a small fortune in the bank, there are still options. Not surprisingly, down payments are lowest in historically cheaper U.S. cities. All of the top 10 metros with the lowest down payments had median sale prices below $300,000.

These places are clustered in the South and Southeast, where home prices have long been lower than the rest of the nation. In Hattiesburg, MS (No. 4), the median home sale price in September was just $220,000, with buyers putting down only about 7.3% to seal the deal.

Less expensive metros were also found across the Rust Belt, where industry-driven population booms were followed by busts as residents left these communities when the jobs disappeared. In Springfield, OH (No. 8), Johnstown, PA (No. 9), and Saginaw, MI (No. 10), less than $200,000 will cover the median home sale. And buyers need only to put down between 8% and 9%.

In Odessa, TX (No. 7), buyers want to kick in as little as possible now more than ever because of the added monthly costs of higher mortgage rates, says Yvonne Rosas, a Realtor with eXp Realty, in Odessa-Midland and the Permean Basin.

“People are trying to get in with as little as possible, hoping for a refi next year,” she says.

Down payments are lowest in places with the most VA and FHA loans

In metros with the lowest down payments, federally backed loan assistance programs play a big role. They include Veterans Affairs and U.S. Department of Agriculture loans, where buyers can put down as little as 0%, and Federal Housing Administration loans, where buyers can put down as little as 3.5%.

In Fayetteville, NC (No. 1), the city adjacent to Fort Bragg, almost two-thirds of all mortgages use a VA loan. That helps explain why the average amount down is just 4.3%. The high number of military personnel means it’s often one service member or veteran selling to another, according to James Walker, a Realtor with All American Realty Group, in Fayetteville.

“Most of the veterans are looking out for each other,” he says. “They’re not looking for anything crazy in terms of the down payment.”

Small down payments are getting bigger, even in more affordable areas

Even in these lower-priced markets, down payments have been on the rise lately, thanks to a surge in demand for housing nationwide colliding with an epic housing shortage. Buyers are eager to make their offers stand out just about everywhere.

The trend is most pronounced in the Rust Belt metros on the list. In Johnstown, Springfield, and Saginaw, all where homes are still very affordable, the average down payment has gone from around 4% to above 8% more recently.

For a place like Saginaw, where home prices also increased in the past few years, the two trends combined mean the dollar amount of the average down payment went from below $10,000 to around $15,000.

!function(){“use strict”;window.addEventListener(“message”,(function(e){if(void 0!==e.data[“datawrapper-height”]){var t=document.querySelectorAll(“iframe”);for(var a in e.data[“datawrapper-height”])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

* Sale price and down payment information sourced from September 2022 monthly Optimal Blue data.

The post 10 Cities Where You Don’t Need a Large Down Payment To Buy a Home Right Now—and 10 Where You Really Do appeared first on Real Estate News & Insights | realtor.com®.