Michael M. Santiago / Getty Images

Homebuyers and sellers have likely heard that America’s real estate market is undergoing a “correction” or “reset.” So how’s that going?

So far, not so great.

We looked at the data in our column “How’s the Housing Market This Week?” We found that several key statistics that would signal that this “reset” is well underway have barely budged.

“Trend indicators, including home price growth, the new listings trend, and time on market changes, didn’t move much, if at all, over the week,” notes Realtor.com® Chief Economist Danielle Hale in her analysis.

As a result, although she concedes that “the housing market continues to reset,” it’s been slow going. Here’s what this means for both homebuyers and sellers.

How the ‘reset’ affected mortgage rates

In June, Federal Reserve chair Jerome Powell announced plans to “reset” the housing market, then elaborated further: “When I say ‘reset,’ I’m not looking at a particular specific set of data. What I’m really saying is that we’ve had a time of a red-hot housing market all over the country, where famously houses were selling to the first buyer at 10% above the ask even before seeing the house. That kind of thing. So there was a big imbalance between supply and demand. Houses were going up at an unsustainably fast level.”

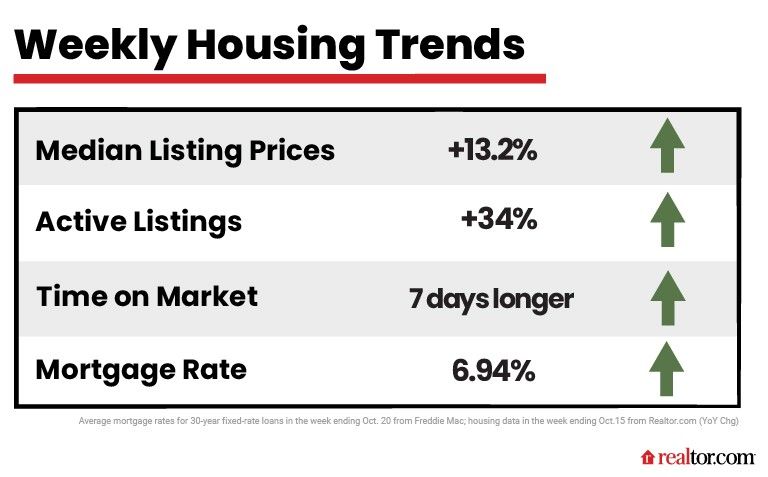

In an attempt to fix this, the Fed has been aggressively and relentlessly raising interest rates all year, causing mortgage rates to more than double from the 3% to 6%-plus range. And for the week ending Oct. 20, the average 30-year fixed mortgage rate edged up even further from last week’s 6.92% to 6.94%, according to Freddie Mac.

As mortgage rates graze and even top the 7% threshold—a level not seen in two decades—the cost to borrow money for a house is rising beyond what many homebuyers can handle. This, in turn, should dampen demand, which should then theoretically cause home prices to tumble in their wake.

But are they? As is the case with the cost of many commodities these days, home prices aren’t caving quite yet.

Why home prices are moving at a ‘glacial pace’

Currently, home prices hover at a national median of $427,250—and for the week ending Oct. 15, prices continued to rise by 13.2% compared with the same week last year, marking the 41st straight week of double-digit price growth.

At first glance, this might look as if home prices aren’t “resetting” at all. But they are, just at a “glacial pace,” according to Hale.

Although it’s hard to notice week to week, monthly data shows that progress is indeed being made. In June, median listing prices grew by 18.2% year over year, to a record high of $450,000. In September, however, prices grew by only 13.9% year over year, to $427,250.

“This signals a true moderation in prices above and beyond the usual seasonal cooling,” Hale says.

“Our data tracks the price of homes that are listed for sale, but not the actual transaction price, and some sellers still appear to be aiming a bit too high,” Hale continues. “While many homeowners are aware of the shift in market conditions that has tilted the market back ever so slightly in buyers’ favor, data shows that a greater share of sellers are still having to reduce their asking price to find a homebuyer.”

Why home inventory levels have jumped

For the week ending Oct. 15, although the number of home sellers entering the market dropped by 15%, overall housing inventory shot up by 34% over this same week last year. That’s the biggest jump in the number of homes for sale seen in 15 weeks.

“This increase in active listings likely reflects the degree to which homebuyers are struggling to navigate the market in light of the increased costs and reduced purchasing power higher mortgage rates have imposed,” says Hale. It also “likely signals fewer home sales transactions ahead.”

These homes will likely stick around on the market longer, too. While properties currently linger on the market for a median of 50 days, for the week ending Oct. 15, they spent 7 more days on the market compared with a year earlier, a pace that’s slowed for 12 weeks straight.

Clearly, home sellers today are facing a very different and much darker reality than those who raked in over-asking bids at blinding speed earlier this year. Combine that with the current misery being experienced by homebuyers, and it’s safe to say that very few are feeling good about the Federal Reserve’s real estate reset so far.

The post How’s the Federal Reserve’s Real Estate ‘Reset’ Going? Not So Great, Latest Statistics Say appeared first on Real Estate News & Insights | realtor.com®.