Design by Realtor.com / Getty Images

In today’s rapidly changing housing market, buyers who’ve hit the snooze button have very likely kicked themselves later—and the most recent real estate statistics may deliver a fresh pang of regret.

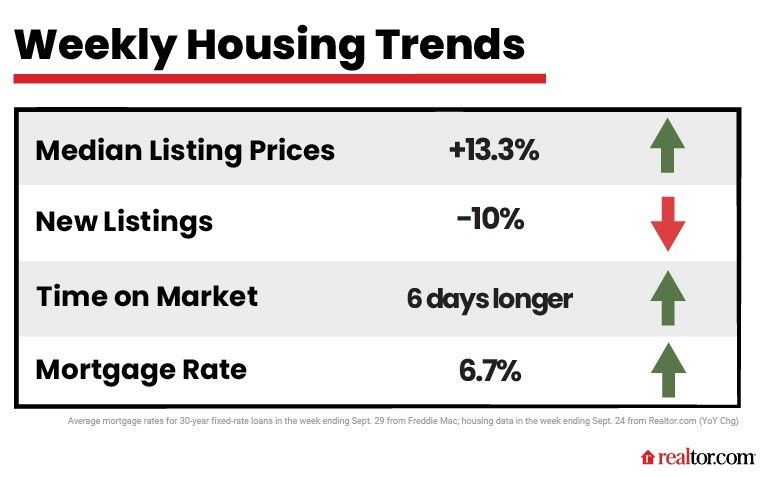

“How’s the Housing Market This Week?” is our weekly column where we keep our fingers on the pulse of four key indicators: home prices, number of listings, time on the market, and mortgage rates. And the week ending Sept. 24 does not look good for buyers, particularly on the borrowing front.

Here’s what the latest numbers say, so that both homebuyers and sellers can brace for what’s ahead.

The latest mortgage rates

Lately, all eyes have been glued to mortgage interest rates, which have more than doubled over the past year from the 3% to 6% range. And they’re still rising fast.

“The rate for a 30-year fixed mortgage passed 6% in mid-September and kept climbing as the recent Fed meeting revealed that projections for the likely policy rate path have gone up as inflation persists,” notes Realtor.com® Chief Economist Danielle Hale in her analysis.

And for the week ending Sept. 29, the average 30-year fixed mortgage rate has continued its alarming upward tear and currently hovers at 6.7%, according to Freddie Mac.

“Mortgage rates rose by more than 1 percentage point in September. As a result, homebuying is 12% more expensive now than a month ago,” says Nadia Evangelou, a National Association of Realtors® senior economist and director of forecasting. “In other words, current buyers need to spend about $250 more every month to buy a median-priced home compared to buyers who purchased their home a month ago.”

While these high rates will continue draining homebuyers’ borrowing power, this misfortune happens to coincide with what Hale calls the “seasonal sweet spot,” which statistics have determined to be the best time to buy a house.

“Late September offers an advantageous combo of available homes and motivated sellers, who are generally more open to negotiation as they try to secure an offer from a smaller pool of buyers,” says Hale. “Shoppers may be able to parlay this shift in market power into a lower sales price.”

What’s happening with home prices

Currently, home prices hover at a national median of $427,000—and for the week ending Sept. 24, prices continued to rise by 13.3% compared with the same week last year.

“The typical asking price of homes continues to exceed last year’s level, hitting a 39th week at double-digit pace,” explains Hale. “Even though home prices continue to grow faster than historically typical, market balance tends to shift in the fall, causing cooler prices.”

In other words, although home shoppers out there today face higher prices than a year ago, they will enjoy lower prices now—by about $23,000—than three months ago, in June, when homes prices hit a record high of $450,000. Count your blessings!

The state of housing inventory today

For the week ending Sept. 24, the number of new listings on the market dropped again by 10% compared with this same week last year. That’s the 12th straight week of year-over-year declines.

“Sellers are less eager to participate in today’s market despite record levels of equity because nearly 3 of every 4 potential sellers would need to also buy a home,” Hale points out. “And rising mortgage rates have cut into the ability of sellers to trade up without increasing monthly housing costs.”

However, overall housing inventory—both fresh listings and stale ones still on the market—is up by 29% over last year. So, home shoppers do have more options today relatively speaking, although it’s nowhere near a return to normal.

“The market is still not back to pre-pandemic inventory levels,” says Hale.

Active listings still trail 2019 levels by more than 40%, she adds. “With seller participation waning, a return to that mark is likely a year or more off.”

Why homebuyers can take their time—but not too much time

While listings today typically linger on the market for 50 days before getting snapped up, that pace has been slowing.

For the week ending Sept. 24, properties spent 6 extra days on the market compared with that same week a year earlier. That’s the ninth straight week of properties sitting idle longer, giving buyers a bit more breathing room to make an offer.

“Shoppers will find that they have a bit more time to make decisions on some properties,” says Hale. However, homes are still selling more than two weeks faster than they did in 2019.

As a result, Hale says, “Buyers should still approach the market prepared to act quickly by getting their finances in order and getting pre-approved for a loan.”

If the housing market has taught us anything in the past year, it’s that those who wait—for lower home prices or lower mortgage rates—may be praying for a miracle that never comes.

As actor Will Rogers once wisely said, “Don’t wait to buy real estate, buy real estate and wait.”

The post Did Homebuyers Just Miss the Sweet Spot To Buy? Here’s What the Latest Statistics Say appeared first on Real Estate News & Insights | realtor.com®.