Realtor.com

After a punishing few years, many homebuyers are simply calling it quits.

And who could blame them? First, home prices began rising to dizzying heights. Then came the insanely competitive bidding wars, complete with mind-bogglingly high offers over the asking price. Now, surging mortgage interest rates are further eating into the buying power of Americans, leading many priced-out homebuyers to throw in the towel. No más!

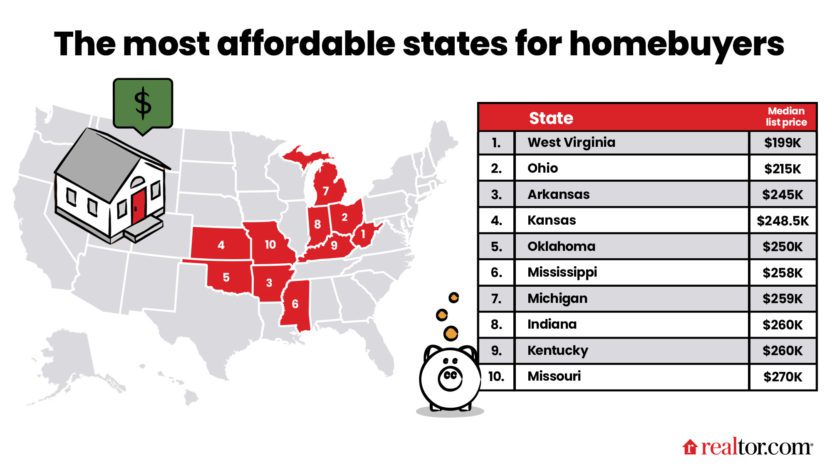

But wait. While home prices are up in nearly every corner of the nation, there are still areas that are less expensive than others. Way less expensive, in fact. That’s why the data team at Realtor.com® identified the states with the most affordable homes in the nation based on median home list prices in April.

Homebuyers on more modest budgets—perhaps with the ability to work from anywhere—can still find real estate deals in these states, even if prices have risen over the past few years. While each of them has some economic challenges, they also have some up-and-coming areas, some pockets of wealth, and plenty of natural beauty. And their median home list prices are far below the national price tag of $425,000 in April, according to the most recent Realtor.com data.

“There have been tremendous transformations in many of these states that previously may have been called ‘flyover country,’” says George Ratiu, manager of economic research for Realtor.com. “What flies under the radar for a lot of people is that many of these states have seen economic growth, which has provided more good-paying jobs. [Paired] with a lower cost of living and more affordability, many of these places have attracted new residents.”

Many of the most affordable states are more rural and don’t have as many huge cities, although there are a few exceptions on our list. They don’t tend to have the thriving tech sectors seen in Silicon Valley, Texas, Massachusetts, and many other burgeoning hubs. That’s meant they haven’t tended to attract legions of workers from other states. However, the economic fortunes of many of these states appear to be changing.

“Most of these states have not seen the typical boom-and-bust real estate cycles that coastal markets saw,” says Ratiu.

The most affordable states are predominantly located in the Midwest and South, areas where land and construction labor are often cheaper and there might be fewer building regulations than on the pricier coasts. This makes it easier—and cheaper—to put up more homes. Lower property taxes in many of these states also make homeownership more affordable for buyers.

The states on the list also offer lots of outdoor attractions, which became more popular with homebuyers during the COVID-19 pandemic.

“Most of these states have an abundance of natural attractions,” says Ratiu. “For a lot of young buyers, families with small kids, that will continue to be a draw,”

OK, for months, or even years, now you’ve told yourself and everyone you know that you’re up for a lifestyle change—and finding a truly affordable house is the key to making it all work. So where will it be?

Realtor.com

1. West Virginia

Median list price: $199,000

True, West Virginia doesn’t exude the glamour, house the high-profile companies, or receive the kind of effortless media attention of New York and California. And the state has had its share of daunting challenges, including being an epicenter of the opioid crisis. But things have begun turning around during the pandemic as more buyers were drawn to the Mountain State’s lower prices and natural beauty. The Appalachian Mountains run through the state as do numerous lakes, rivers, and hiking trails.

“For an outdoors-oriented person, West Virginia has a lot to offer,” says Ratiu.

Over the past two years, Debra Sullivan, a Realtor®, has seen more buyers from more expensive parts of the country coming into Morgantown, the state’s third-largest city, in the northern central swath of West Virginia. (Median home list prices in Morgantown were $317,700 in April, according to Realtor.com data.) They’re looking for affordability plus outdoorsy amenities as well as proximity to airports and top-notch medical facilities.

“Buyers are looking for areas that have lower prices and lower property taxes, but access to things they enjoy,” says Sullivan, of J.S. Walker Associates.

However, even though prices are lower in many parts of West Virginia, it doesn’t mean it’s easy to get a home right now.

“You’re going to be paying at or above what a property is worth with multiple offers,” Sullivan says. Many buyers are resorting to waiving appraisal contingencies. That means if the home doesn’t appraise to what they offered for it, they will make up the difference. Finding a home under $250,000 “is really, really difficult.”

2. Ohio

Median list price: $215,000

Ohio was once a manufacturing powerhouse, with thriving cities like Cincinnati, Cleveland, and Dayton. However, like most of the Rust Belt, the state fell on hard times when many manufacturing plants closed or downsized. As residents left and there weren’t as many new folks coming in, home prices fell.

Now the state is hoping to reclaim its manufacturing mantle with Intel building a $20 billion chipmaking factory just outside of the state’s capital of Columbus. The new facilities are expected to create 3,000 Intel jobs and support 7,000 construction jobs—in addition to tens of thousands of positions for suppliers and partners.

“The local sentiment is it will give a very serious boost to the local economy in Central Ohio,” says Itzhak Ben-David, academic director of the Ohio State University Center for Real Estate. The school is located in Columbus.

He attributes the lower prices to more abundant land available for construction and lower, local earnings. There also hasn’t been as much demand for homes from folks from other parts of the country. In April, median list prices in the state fell about 1.5% compared with a year earlier.

“Not many people come from Florida to buy a second home in Ohio,” says Ben-David. “There are no [big] tourist attractions, [seaside] sandy beaches.”

3. Arkansas

Median list price: $245,000

Don’t sleep on Arkansas, where former President Bill Clinton served as the governor twice. It’s home to the nation’s largest retailer, Walmart, which is headquartered in Bentonville, in the northwestern edge of the state. Tyson Foods, which touts itself as the second-largest chicken, beef, and pork processor and marketer in the world, is headquartered about 30 minutes south in Springdale.

Homes in Bentonville are much pricier, with a median list price of nearly $549,00 in April. But buyers can still find some deals such as this four-bedroom, two-bathroom, single-level brick home for $379,000. Those who don’t need as much space can check out this two-bedroom, 1.5-bathroom house with an above-ground pool for $249,500.

Buyers in Springdale can find more deals as the median home price is much lower, at $375,000 in the week ending May 21. This newly remodeled three-bedroom, 1.5-bathroom house is listed for $265,000.

Fun fact: The Crater of Diamonds State Park, in Murfreesboro, is the only active diamond mine in the country.

4. Kansas

Median list price: $248,500

There’s no place like home, there’s no place like home—in Kansas—for buyers seeking affordability.

In Kansas City, KS, the state’s third largest city, the median home price was just $190,000 in April. (It’s important to note, though, that the Kansas City metro area straddles the state line with Missouri.) However, competition for lower-priced real estate is fierce, says Mary Hutchison, a Realtor with Better Homes and Gardens Real Estate in Kansas City. Her office is located in the suburb of Prairie Village.

“There’s still quite a bit of competition for nicely updated, starter homes priced at $350,000 or under,” she says. On the plus side for buyers, “we are seeing a little bit of slowing down for showings of the more expensive homes [and] not as many multiple offers.”

Buyers can pick up this three-bedroom, 1.5-bath home for $170,000 or this three-bedroom, one-bath house for just $110,000.

She attributes the lower prices in Kansas City—well known for its barbecue, jazz, and arts museum—to its status as a smaller-sized urban real estate market.

“Our prices have always been much more affordable than a major metro area,” says Hutchison. “We don’t have national name recognition like a bigger city, but there are quite a bit of things to do here.”

5. Oklahoma

Median list price: $250,000

During the pandemic, many folks from more expensive, blue states looked for homes in Oklahoma. Some were drawn to the state’s more conservative politics, others by the alluring prospect of just how far their money could go here, says Oklahoma City-based real estate broker Becky Ivins. (And some came for both!)

“You can live like a king in Oklahoma City,” says Ivins, of Movers Real Estate. She’s based in the state’s eponymously named largest city, where the median list price was $270,000 in April. “The cost of living is less. We’re not the coasts, we’re not New York City, we’re not Florida. Those have always been higher.”

This three-bedroom, 1.5-bath, brick house with a two-car garage in Oklahoma City is on the market for just $146,000. Buyers can also choose from this three-bedroom, two-bathroom, single-level house along a walking trail for $199,900.

Even with builders putting up more homes, buyers can expect quite a bit of competition. Before mortgage rates jumped up, Ivins was seeing 15 to 20 offers on homes. Now, it’s slowed down to between five and seven. That’s still quite a bit.

“People can afford less house now,” says Ivins.

6. Mississippi

Median list price: $258,000

While Mississippi home prices might seem affordable compared with, say, the city of San Francisco—where median prices are more than $1 million higher—they’re still higher than what many locals would like.

“We’re increasing just like the rest of the country,” says Angelia Clark, owner of Re/Max Results in Real Estate in Gulfport, MS. Statewide, list prices rose about 13% year over year in April, according to Realtor.com data. Within Gulfport’s city limits, prices jumped 7.5%, to $249,900 in April. “Demand is up just like everywhere else and, of course, our supply [of homes] is low.”

Those price hikes have been hard for locals in Gulfport, the state’s second-largest city located on the Gulf of Mexico.

“We have casinos and tourism. But we don’t have a lot of high-paying, industry jobs,” says Clark. That means there’s a limit to how much residents can pay for homes, especially with higher mortgage rates. “The other part that keeps prices down is the cost of our home insurance. We are in a hurricane-prone area. … A lot of our areas also require flood insurance.”

The city was devastated by deadly Hurricane Katrina in 2005, then hit again by Hurricane Ida last year.

Clark has seen a lot of out-of-state investors looking for rental homes and vacation-home buyers searching for condos in the area.

This three-bedroom, 1.5-bathroom bungalow in Gulfport, with beach views from the backyard, is on the market for $159,900. Those looking for a condo can check out this two-bedroom, 1.5-bath within walking distance to the beach for $137,500.

7. Michigan

Median list price: $259,000

Like several of the other Rust Belt states on this list, Michigan was once a manufacturing juggernaut. Detroit, aka the Motor City, was home to Henry Ford‘s first automotive plant, built in 1904. More than 100 cars a day were assembled in that plant during the 1920s, according to Curbed.

The city’s decline began in the 1950s and accelerated into the 1960s. Detroit, and the surrounding areas, lost residents as some auto manufacturing jobs disappeared overseas. Demand for homes dropped along with prices.

Between 2010 and 2020, Michigan had one of the slowest population growth rates in the nation, according to the U.S. Census Bureau. That’s despite more cars and trucks still rolling off Detroit area assembly lines than anywhere else in the nation, according to the Detroit Regional Chamber.

“We don’t get a lot of people moving to Michigan, except corporate transferees,” says Detroit-area real estate agent Tom Nanes, of Community Choice Realty Associates.

That might help to explain why prices in the state fell by 0.36% in April compared with a year earlier. Prices were down 9.8% in Detroit, to $74,900 within the city limits.

8. Indiana

Median list price: $260,000

Indianapolis, the largest city in Indiana, was recently named one of the nation’s most affordable, larger real estate markets by the National Association of Realtors®. List prices in the city jumped 10.6% annually in April, to a median of $259,900.

“The people who have always lived in Indianapolis would not concur that we are so affordable anymore,” says Kristie Smith, managing broker of Indy Homes in Indianapolis. However, she’s seeing the market beginning to slow down as higher mortgage rates are making it more difficult for buyers to offer quite as much.

She saw a lot of clients hailing from Chicago coming into the city, drawn by its lower taxes and greater affordability.

“Our taxes are low, our land prices are low, our home prices are low,” she says, compared with pricier parts of the country.

Buyers can scope out this two-bedroom, 1.5-bathroom, two-story townhouse with a one-car garage on the market for $149,900. It comes with a wood-burning fireplace and patio. Those who prefer a stand-alone home might be interested in this updated four-bedroom, 2.5-bathroom house with a detached garage and a fenced-in backyard for $195,900.

9. Kentucky

Median list price: $260,000

Long known for tobacco and textiles, Kentucky has emerged as a major manufacturing center. One of the nation’s largest airport terminals for cargo is located in the largest city in the state, Louisville, as is Fortune 500 company Humana, a health insurance provider.

Many out-of-state homebuyers have looked in Kentucky in search of larger properties on several acres—or more—of land.

Louisville, home to the famed Kentucky Derby, had a median price tag of $257,900. And while home prices are still rising, they were up only 4.9% in April—a much more modest rise than the 14% hike seen nationally.

Buyers can take a peek at this three-bedroom, 1.5-bathroom ranch with a skylight in the kitchen and a carport for $200,000. This three-bedroom, two-bathroom house features a first-floor primary bedroom with a walk-in closet for $179,900.

10. Missouri

Median list price: $270,000

Here’s an interesting trivia tidbit about Missouri: Eminem, Maya Angelou, Mark Twain, and Harry S. Truman were all born in the state. And buyers can still find plenty of real estate deals here as well.

In “Missouri, like many Midwestern states, the price levels are much lower than the East and West coasts because the land is less expensive,” says real estate broker Jim Meyer, of MeyerWorks. “Historically, it hasn’t been as expensive to develop a suburb as in other parts of the country.”

He’s based in the Columbia area, which is the state’s fourth-largest city, where the median home price was $348,000 in April. It’s smack dab in the middle of St. Louis, two hours east, where home prices are significantly lower, at a median $200,000, and Kansas City, two hours west. (Kansas City straddles the Missouri/Kansas state line.)

Buyers in Columbia, which is popular with students attending the University of Missouri as well as retirees, can check out this newly remodeled three-bedroom, 2.5-bathroom house for $225,000. Those looking in St. Louis can score a four-bedroom, two-bathroom Cape Cod for $164,900.

___

Watch: Relax for Less: The 10 Most Affordable U.S. Beach Towns for Homebuyers

The post Sick of Skyrocketing Prices? Escape to These 10 States for the Cheapest Homes appeared first on Real Estate News & Insights | realtor.com®.