Getty Images

Over the past year or so, we’ve heard about people doing nearly anything to get a house in this crazy market, including waiving inspections, making all-cash offers, and writing heartfelt personal letters to sellers. Vicious bidding wars have broken out across the country, with starter homes going for more than $100,000 over list price in some markets. And with home prices soaring even higher, you’ve got to wonder: How much does it take to clinch the deal?

The reality is that with more homebuyers in the market than there are properties for sale, sellers should have the upper hand. The data team at Realtor.com® wanted to see where prospective buyers should be prepared to pony up the most over asking price—and how much—and where they may be able to offer a little under asking and still secure the home.

We found big bidding wars in suburban enclaves, as city dwellers look for more space and for less money than they’d pay in larger, more expensive urban centers. While there has been a bit of a slowdown in recent months, prices and demand for homes are continuing to rise in the suburbs, where properties can sell in mere hours.

On the flip side, places where homes sold below asking price tended to be bigger cities or suburbs right outside city limits, where prices were already very high and there has been less demand recently.

Meanwhile, because of how quickly things are changing in this market, there’s become a disconnect between what sellers should ask for and what buyers are willing to pay.

“In a normal market, most homes end up selling slightly below asking,” says George Ratiu, senior economist at Realtor.com. Historically, homes across the country have sold for about 3% to 4% below the asking price, so this trend could be a welcome sign of a market that’s becoming a little more buyer-friendly.

To be clear, this doesn’t mean such areas are losing value. In some cases, sales prices are rising but haven’t caught up with asking prices. Similarly, sellers looking to capitalize on this exponential price growth may have been overly ambitious with their pricing strategies.

“No one wants to leave money on the table,” says Elizabeth Casey, a senior real estate specialist at William Raveis Real Estate in Greenwich, CT. Homes in Greenwich are selling for about 4% below the asking price on average. Some sellers are listing for more than the house is really worth, she notes.

Last month, the national median list price was a staggering $385,000—up 12.7% from the year before. Most of that price growth is being seen in the suburbs, as having more space is a more valuable feature these days than proximity to the office. And as people move farther from expensive cities, their dollars can go further. So prospective buyers are more willing to kick in a little extra, especially with mortgage interest rates so low, to get a place to call their own.

To come up with this list, we looked at sales in nearly 1,500 U.S. cities during the first three months of 2021. We compared the final sales price with the last-known list price to see where homes were selling for way above (or below) what the owners were asking for. Then, we calculated the average amount over or under the asking price buyers ended up paying in those cities.

So where are we seeing the biggest disconnect between buyers and sellers? Let’s take a look.

Tony Franzel for Realtor.com

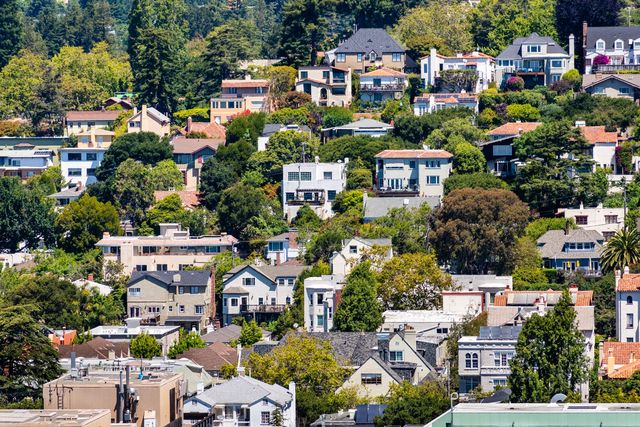

1. Berkeley, CA

Getty Images

Median list price: $1.2 million

Average increase over asking: 19%

San Francisco, one of the nation’s most expensive cities, bore the brunt of remote-work-eligible people fleeing urban centers during the COVID-19 pandemic looking for cheaper living options and more space. Some decided to leave the area—or the state—altogether, while others made the shorter move across the bay to Berkeley. This college town (home to the University of California, Berkeley) offers buyers more space and a bit of a break from what they’d pay in San Francisco. Just don’t expect college-budget prices.

Like the rest of the Bay Area, Berkeley’s housing market has soared over the years due to the tech boom. Its current median home price is $1.2 million. Bidding wars can drive these astronomical prices even higher, with homes selling about 19% above asking on average.

For those who live here, it’s not surprising, says Aman Daro, chief operating officer for local Red Oak Realty. Seller’s agents in the area routinely price homes below what they think they’ll go for, to drive up competition, he says. So buyers should factor that in when deciding their budget.

“It’s a pricing strategy that encourages as many buyers as possible to compete for a home,” Daro says. “This is how this world works in the inner East Bay. [Buyers should] plan to spend 20% to 30% over asking.”

One example of how crazy the market is here: Earlier this year, one home in Berkeley reportedly received 29 offers in 11 days and ended up selling for $1 million over asking.

2. Montclair, NJ

Getty Images

Median list price: $829,050

Average increase over asking: 14%

The pandemic caused many New York City residents to flee their tiny apartments and head to the suburbs. Many landed in upscale Montclair, NJ. A little over an hour by train to midtown Manhattan, Montclair is an artsy commuter town with spacious homes and yards to enjoy on the weekends.

Parents and young professionals planning to start a family have been lured by the good public schools and (comparatively) lower cost of living. Plus there are plenty of good restaurants, cute boutiques, and an indie movie theater.

But with increased interest, the number of homes for sale has reached record lows. Active listings shrank to just 77 last month, down 29% from the same time a year ago, according to Realtor.com data. That means buyers have to try extra hard to stand out, including by making high offers.

A four-bedroom Dutch Colonial is currently on the market there for $779,000—but prospective buyers should be prepared to pay a bit more than that.

3. Champaign, IL

Median list price: $227,500

Average increase over asking: 13%

Located two hours south of Chicago and two hours west of Indianapolis, Champaign is great for those who want to save some cash—while remaining just a drive away from big-city perks. That makes it somewhat commutable for those who have to go to their office in the big city only one or two days a week.

There are also plenty of jobs much closer to home in Champaign and its sister city, Urbana. They are home to the University of Illinois at Urbana-Champaign, the flagship of the state’s public university system. The university’s Research Park, established in 1999, has grown into a technology hub with more than 100 companies (including the research and development arms of major multinationals like Caterpillar and Verizon Media Group). Kraft Heinz is another large, local employer.

The inexpensive housing stock is also a draw, with a median home price well below the national median. Investors are also drawn to homes that can serve as rental properties for the population of more than 50,000 students. A three-bed, two-bath home with 1920s charm and a fenced yard is currently on the market for $239,900.

4. Clearfield, UT

Median list price: $389,550

Average increase over asking: 10%

The real estate market in Utah has been white-hot over the past year or so, and Clearfield is no exception. The Salt Lake City suburb is part of the Ogden-Clearfield metro area, which made the list of our hottest housing markets in February, based on page views and how quickly homes were selling there. (In June, it took only five days for the average home to sell, a whole two weeks faster than the same time a year ago.)

Part of the reason is that buyers from places like California and Arizona have been scooping up homes in Utah during the pandemic. They’re lured by the great outdoors, lower prices than in their home states, and a strong economy. But that’s not the whole story.

The number of homes on the market has been low since the Great Recession in 2008. Meanwhile, people love living here, so fewer people are leaving. With the influx of out-of-staters, there are more people trying to buy houses than ever before.

Prospective buyers can take a look at a three-bedroom, single-family home listed for $349,900.

5. Olathe, KS

Median list price: $471,850

Average increase over asking: 10%

This Kansas City suburb is popular with families and young professionals, lured by the lush greenery, plenty of things to do, and highly rated public schools. While nearby Kansas City is a major employment center, some big companies call Olathe home. GPS maker Garmin was founded and is still based here, while Farmers Insurance employs more people in Olathe than it does in its California headquarters.

But it’s not only first-time homebuyers capitalizing on record-low interest rates who are looking to buy here, says local agent Maggie Foster, with ReeceNichols. Buyers from out of state have also been looking to invest in properties in Olathe. These investors may be more willing to pay more upfront, especially if they have more cash on hand.

Overall, Foster’s advice to prospective buyers is to be mentally prepared not to get the first house they fall in love with.

“Be resilient. You’re probably going to miss out on five to six offers on average, and that’s OK,” she says. “At the end of the day, it really does work out for the best and you’ll get the house that is right for you.”

Rounding out the top 10 were Bothell, WA, a Seattle suburb (where homes go for 10% over asking on average); Kansas City, MO (9%); Idaho Falls, ID (8%); Jeffersonville, IN (8%); and the Dallas suburb of Rowlett, TX (6%).

1. North Miami Beach, FL

Getty Images

Median list price: $850,050

Average reduction from asking: 7%

Even before the tragic building collapse in North Miami Beach last month, buyers here have been able to negotiate better prices for their beachfront properties. Part of the reason is the sheer number of condos for sale, after a development frenzy a few years ago where builders raced to erect new luxury condo developments.

Florida has become one of the most popular relocation destinations during the pandemic, but despite its white-hot housing market, condos just haven’t had the same appeal as single-family homes. This is especially true when buyers are prioritizing space over pretty much anything else. Another issue is the decline in international buyers, due to COVID-19 travel restrictions.

With more options, buyers also have more room to negotiate. It also means sellers may be more amenable to accepting an offer below the asking price.

2. New Castle, DE

Median list price: $240,050

Average reduction from asking: 5%

Located about 10 minutes from the state’s capital of Wilmington, New Castle is a historic town with plenty of parks and things to do. But like other cities on this list, sellers here may have gotten overzealous when deciding how much to list their homes for.

The median list price in New Castle in June was $240,050—up a jaw-dropping 23% from the same time a year ago. That’s significantly higher than the 13% year-over-year price growth nationally over the same period.

But on average, homes here are actually selling for slightly below that. This disconnect means that those looking to buy a home here may have the ability to make an offer a little under asking. Or at the very least, the bidding wars may be a little less heated than in other parts of the country.

Those looking to put down roots here can scoop up a quaint four-bedroom, 1.5-bath, Cape Cod-style house for $225,000.

3. New York, NY

Getty Images

Median list price: $1.45 million

Average reduction from asking: 5%

New York City has come a long way since becoming the epicenter of America’s COVID-19 pandemic last year. But its housing market, while back on the upswing, hasn’t fully recovered yet.

Of the five boroughs, Manhattan real estate was most affected by the pandemic because of its wealthier, more mobile residents. In the early days of lockdown, the borough lost thousands of residents. Those who could afford it simply headed to vacation homes in places like the Hamptons, or north to Westchester County and beyond, to get more space and a backyard to ride out the crisis.

With fewer people wanting to live right in the city, sellers are having to temper their expectations on what they can get for their properties.

4. Beverly Hills, CA

Median list price: $6.3 million

Average reduction from asking: 5%

Beverly Hills has long been one of the most expensive ZIP codes in the country, thanks to its massive mansions and the celebrities that call it home. But the need for more space during the pandemic led people to look beyond this uber-wealthy enclave.

Those looking for more privacy have gone up the coast to Santa Barbara and Montecito, where celebrities like Prince Harry and Meghan Markle, Rob Lowe, and Ariana Grande have put down roots. Meanwhile, some less famous Californians have simply relocated to states with lower costs of living.

But that doesn’t mean Beverly Hills is now out of style. Savvy sellers just want to make sure they’re getting top dollar for their properties, so they’re seeing just how high they can get away with listing their homes—and sometimes overreaching.

“There are just a lot of overzealous sellers really looking to take advantage of the market,” says Scott Tamkin, a founding agent with Compass Los Angeles.

That includes a five-bedroom, seven-bath currently on the market for $5.5 million.

5. Northbrook, IL

Median list price: $627,000

Average reduction from asking: 4%

Northbrook, just outside Chicago, is known for its quintessential suburban feel and inspired several of director John Hughes‘ films in the 1980s. The local high school here was featured in “Ferris Bueller’s Day Off” and “The Breakfast Club.”

But since the pandemic, proximity to the big city is no longer a must-have for many buyers. Instead, those looking to move are prioritizing space and lower prices, so they’re willing to expand their search farther beyond the Windy City.

Sellers hoping to get the best price for their homes are sometimes just asking for too much, says local broker Betsy Phillips, a Realtor with Compass. That’s especially true when it comes to savvy, younger buyers who do their research.

She cited one house for sale in her neighborhood that was listed for $100,000 more than what the seller paid for it two years ago, despite having made no renovations.

“That’s not happening,” she says. Instead, buyers, especially millennials and first-timers, are being picky, looking only at homes that are move-in ready and check all the boxes.

Her advice to buyers is to be reasonable with their pricing. Homes priced on the lower end will almost definitely see bidding wars, Phillips says. Aiming too high could turn off buyers and lead to more days on market.

“If you overprice your house, that’s the kiss of death,” she says.

Finishing the bottom 10 were the Detroit suburb of Bloomfield Hills, MI (4%); Boston (4%); the New York City suburb of Greenwich, CT (4%); Corpus Christi, TX (4%); and Stillwater, OK (4%).

The post Out of Sync: Where Homes Are Selling the Most Over (and Under) Asking Price appeared first on Real Estate News & Insights | realtor.com®.