Getty Images

Since President Donald Trump left office in January, sales of his firm’s Trump-branded properties have risen exponentially—likely due to the cut-rate bargain price tags at the majority of his high-rise towers across the country.

Although real estate prices have been rising just about everywhere, the overall prices of Trump’s U.S. properties have declined steadily throughout his four years in office. It’s a signal that the Trump luxury real estate brand, which Trump carefully, and at times ruthlessly, spent a half-century building, may have lost some of its luster during and after his political tenure. It’s also reflective of the fact that some of the older properties are considered outdated in today’s competitive luxury market.

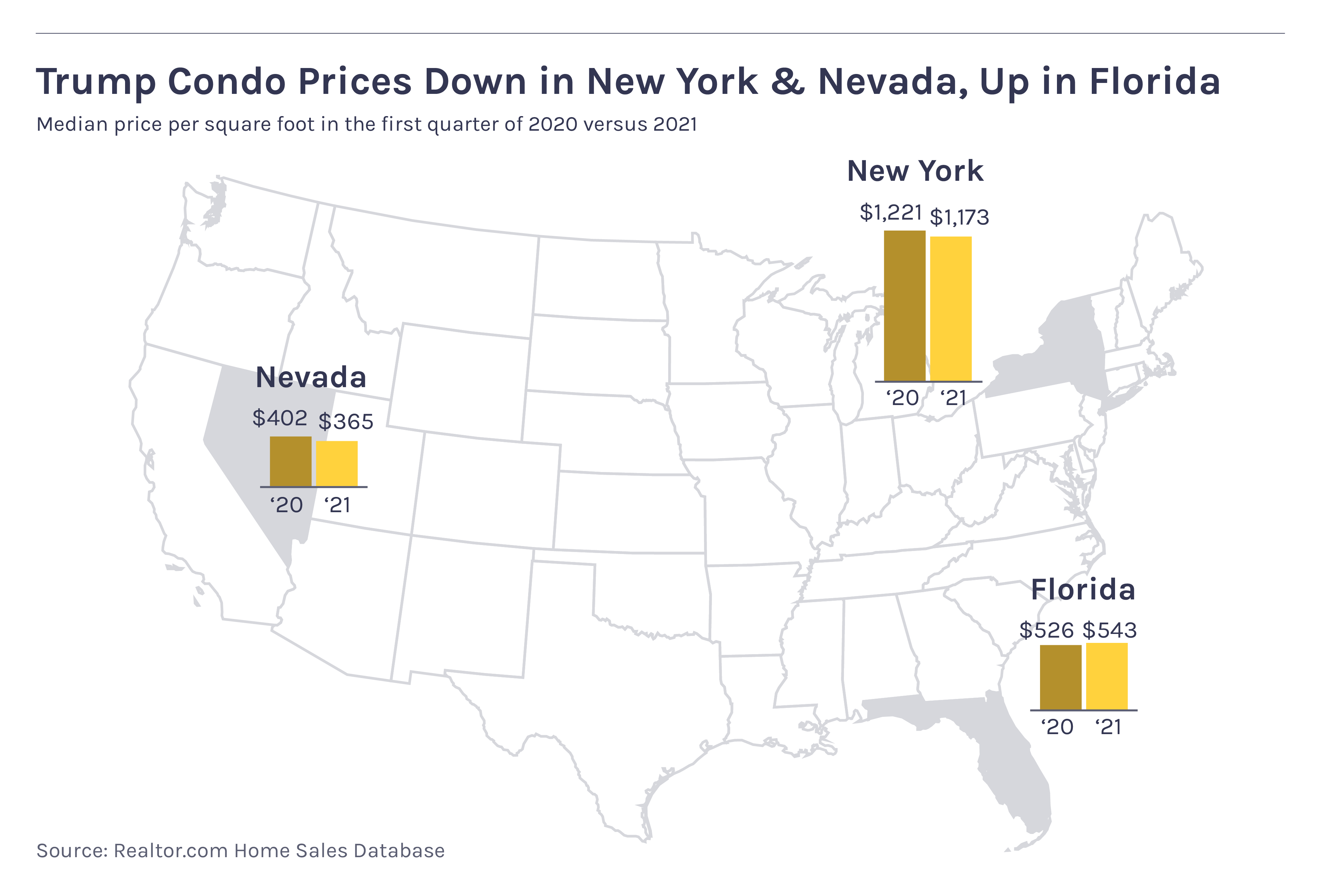

While prices at Trump-branded properties have been going down overall nationally, they are stronger in some states—particularly Florida, where they have actually risen—than they are in the other areas in which he operates, where prices have shown substantial declines.

Most of the recent sales have happened at Trump’s Florida properties. The former president, a longtime New Yorker, decamped to the state, which he won in 2020 and where he continues to have strong support. But there was also an increase in sales activity in New York and Nevada, states that went blue in the last election. Sales at his Hawaii, Connecticut, and New Jersey properties were little changed, while sales at the Trump International Hotel and Tower Chicago fell slightly.

Much as with the real estate developer-turned-reality TV star-turned-former commander-in-chief himself, how people feel about Trump properties varies greatly on whom you ask—and where they are.

To see how Trump properties have fared since he left office, the Realtor.com® data team analyzed sales in all of the U.S. residential buildings listed on the Trump Organization’s website that had data available from January 2016 to 2020. These 24 buildings, located in seven states, come in many forms, including high-rise towers in Manhattan, luxury beachside condos in Florida, and hotel condominiums in Las Vegas and Hawaii.

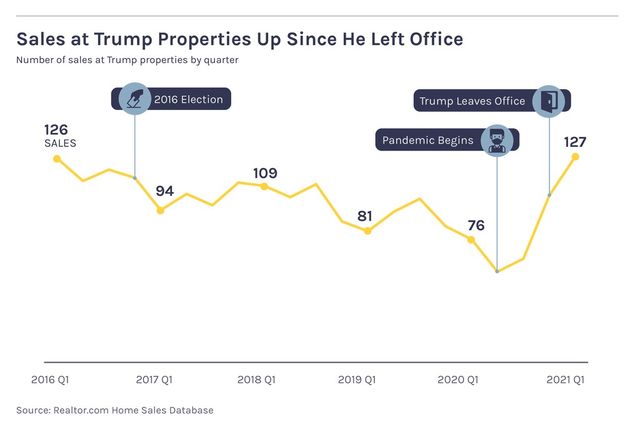

In the first three months of this year, the number of sales in the roughly two dozen U.S. properties listed on the Trump Organization’s website jumped 72% compared with the same period last year. But the median prices for these properties, generally condos, have fallen 24% since the beginning of 2016, when Trump ramped up his presidential campaign.

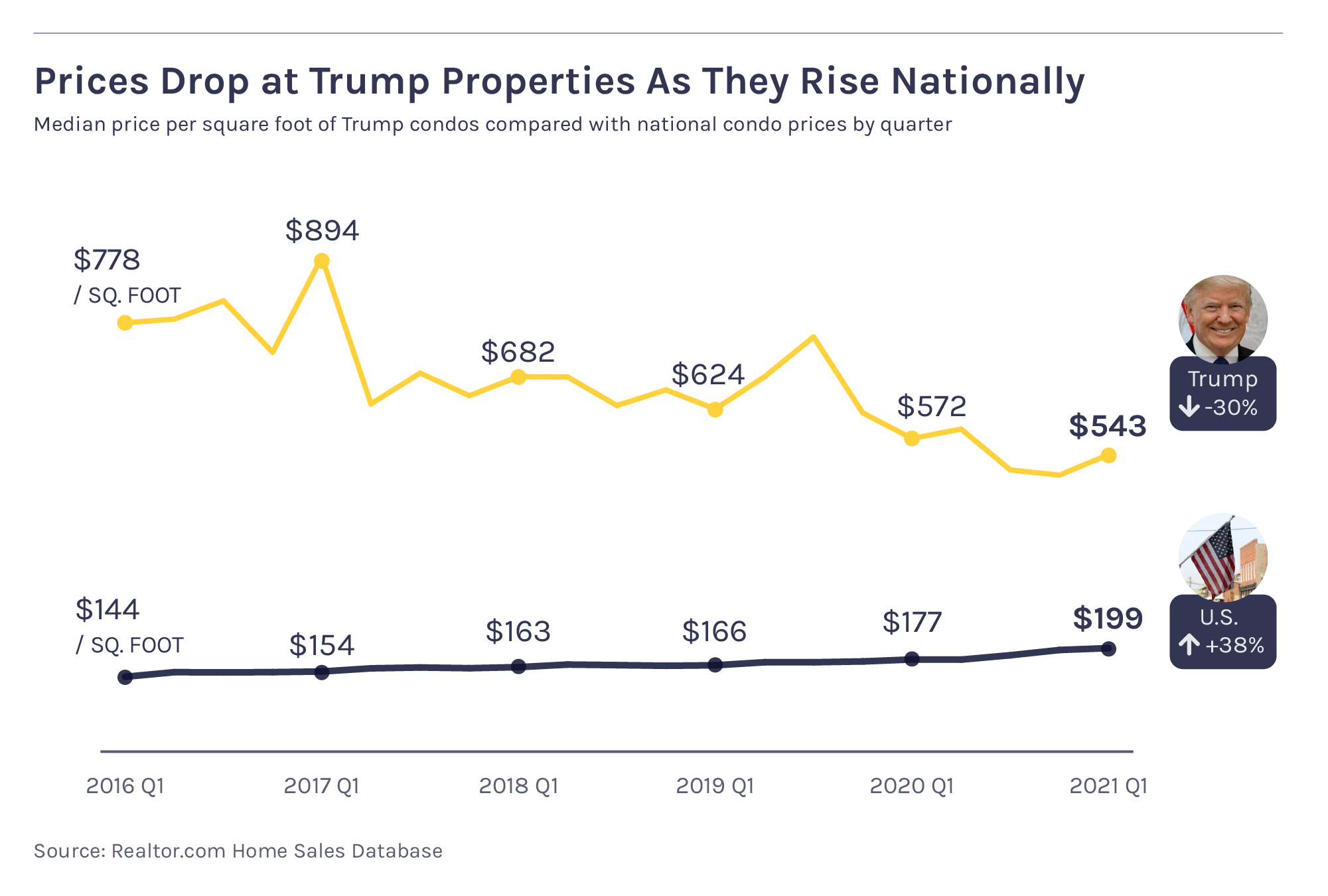

To ensure the comparison was fair and sales of penthouses or smaller units weren’t skewing the numbers, we adjusted for the median price per square foot at his properties. It showed that the price per square foot fell by 30% in the past five years.

Jessica Schillinger for Realtor.com

“Of course the Trump brand has taken a hit [since his presidency]. He’s a controversial character now,” says Matthew Quint, director of the Center on Global Brand Leadership at Columbia Business School. “When he made the decision to run for president, by nature he was going to change the perception of the Trump business brand.”

After four years in office, Trump has become a highly polarizing figure. A Pew Research report released in March showed Americans were divided when it came to rating his presidency. Split along party lines, 73% of Republicans said Trump was a great or good president, while 72% of Democrats said he was a terrible one.

Of course, this all coincides with a once-in-a-generation pandemic that upended the economy as well as the real estate market. Across the country, the number of condo sales rose 23% in the first quarter of 2021 compared with the same time the year before, when low mortgage rates helped kick off a buying frenzy.

Over the past four years, condo prices have risen about 38%. That’s in sharp contrast to what happened in Trump properties, which dropped 30% over the same time period.

Sales are strong in the Sunshine State

Bucking the trend, prices at Trump properties in Florida have been strong—although not quite strong enough to offset the declines in the rest of the country.

Jessica Schillinger for Realtor.com

Lately Florida’s real estate market has been booming and Trump’s properties there have been popular with buyers, says Denise Rubin, president of the Denise Rubin Group and a real estate agent with Coldwell Banker Realty. She’s sold 10 units so far this year in Trump Hollywood (in Hollywood, FL), including the highest sale in the building: a six-bedroom, 6.5-bath, top-floor unit, which went for $3.95 million.

In all, 39 units were sold in Florida during the first three months of 2021. Prices there rose, too, with the median reaching $1.03 million per unit, up from the previous year, when the median was $920,000, according to Realtor.com analysis.

“For all the people I’m selling to, it’s still a status symbol,” Rubin says. “They’re happy with the Trump name, and the prices are great and going up.”

Most of the clients she’s working with are international, with many from Russia.

But she’s seen an increase in buyers coming from places up north like New York and New Jersey. She says they’re enticed by the plentiful amenities (a gym, spa, and 24/7 concierge, for example) in the Trump properties and friends in the building. Politics doesn’t come up too often, but Rubin says many of her American buyers are Trump supporters.

Down the coast, Jerry Ardizzone recently purchased a unit in Trump Towers, located in Sunny Isles Beach, FL. The Californian was looking for an investment property as well as a place where he could visit his parents and eventually retire one day. While he is a Republican, he says the Trump name had little to do with his decision to buy there.

“I liked the Tower, I liked the amenities, I liked the price,” Ardizzone says. “I’m on the sand, and Florida’s hot right now for resale.”

Property sales in Florida have increased throughout the pandemic as people who could work from anywhere sought out warmer weather, fewer COVID-19 restrictions, and lower taxes. There has also been a shift in what buyers are looking for, says luxury real estate agent Mary Jane “M.J.” McElwaney, of the Nicklaus Vance Realty Group in North Palm Beach. She operates near Trump’s new primary residence, his Mar-a-Lago country club.

“The market has changed from vacation homes where people lived for just a few months to a primary-residence market,” McElwaney says. That means potential buyers are looking for more space and may be willing to spend more since they’ll be living there full time.

Bargains abound in the Big Apple

In an ironic twist, the Trump name has finally become a hot ticket in his former hometown, deeply Democratic New York City. Sales at his properties rose 16% in the first quarter of this year. But before the former president rushes to reoccupy his golden penthouse suite in the Trump Tower, he may want to look closer: The median prices on those sales fell significantly.

Condos dropped in price throughout the city, as people left Manhattan for the suburbs or other states where they could get more square footage for their money during the COVID-19 pandemic. But in Trump-branded buildings, the median price per square foot fell 18%, compared with just 7% in New York City condos overall.

Jessica Schillinger for Realtor.com

A recent buyer of a unit in Trump Place on Riverside Boulevard in Manhattan, who requested anonymity, was enticed by the low prices and viewed his purchase as a good long-term investment.

“It was a good value at the time,” the buyer says.

While the Trump name may be toxic to some New Yorkers, the main issue driving deep discounts is that many of his properties were built in the 1970s and ’80s, so layouts, fixtures, and amenities are simply no longer in style. Meanwhile, a luxury condo boom in the city during the 2010s has led to a glut of available newer properties and pushed some Trump properties out of the luxury bracket.

Still, they’re doing about as well as other buildings constructed then, says Donna Olshan, a luxury broker and president of Olshan Realty.

“They’re not going to hold up to the rest of the market because they’re mature,” Olshan says. “What a buyer goes for in a condo is brand-new construction.”

Another part of the drop may have to do with the type and size of the condos sold. Ahead of the presidential election, in the first three months of 2020, the Trump Organization sold several high-priced units, including the penthouse at its tony 610 Park Avenue property for $32 million. During the same time this year, the most expensive property sold was a three-bedroom unit at Trump World Tower, which went for $4.99 million.

Overall, Olshan says, it’s less about the politics and more about the product.

“I don’t think they are any worse for the wear because they have his name on the building,” she says. “They just have to be judged as mature, 30- to 40-year-old condos.”

Buyers luck out in Las Vegas

At the Trump International Hotel Las Vegas, sales at his combined condo-hotel property more than doubled compared with the same time last year. But prices were way down.

The median price for a unit in the building was $195,000 in the first quarter, down 13% from $225,000 in 2020. However, prices at other luxury properties in the state rose over the same time period.

Part of the reason for the drop is buyers’ renewed focus on square footage, says Bruce Hiatt, a real estate broker and owner of Luxury Realty Group in Las Vegas. Since the pandemic, “bigger is better” has become the common buyer’s refrain, and small to midsize condos here aren’t nearly as much in demand as single-family homes or truly expansive condo apartments.

Another issue is that, like other condo-hotels in the area, the Trump International was built in the late-2000s, so it’s nearing time for an upgrade. It now has to compete with newer buildings with updated features and open floor plans, including the nearby Waldorf Astoria Las Vegas. Over time, the fully furnished units in Trump International have become less desirable, and include dated features like granite counters, Italian marble tile, and frosted-glass showers.

“You’re starting to approach what I call the refurbish cycle,” Hiatt says.

Condo-hotels are also viewed as investment properties, so some lenders won’t finance a sale in those types of units. That means a chunk of buyers has to rely on cash deals, limiting the pool of potential customers. That’s seen in the data: More than half of Trump International buyers in the first quarter of this year were corporate investors. A third factor could be that the property is one of only a few condo-hotels that doesn’t have a casino attached.

“It’s a nice building, but it’s pretty isolated other than the fact that you have Fashion Show Mall across the street,” Hiatt says, referring to the massive shopping complex that’s a must-stop destination for fashionistas. “It takes a very specific buyer to be interested in that specific property.”

Where things go from here

Looking ahead, brand expert Quint says the future of the Trump name in real estate may still be tied to politics—in particular, what happens during the 2022 midterms and 2024 presidential race. Trump has already begun campaigning for congressional candidates and has indicated that he may choose to run again for president in three years.

If he can successfully lead the Republican Party to take back the House and win a second term, that will keep him at the forefront of people’s minds, says Quint. That makes it harder to separate the man from the brand, and things could become even more divisive depending on how the vote is split.

Pending legal troubles could also have an impact on the brand. The Trump Organization is currently under investigation by both the Manhattan district attorney and the New York attorney general’s office. Part of the probe includes whether the company reported false property values to obtain loans and receive economic and tax benefits.

On Friday, the New York Times reported the Manhattan DA may bring criminal charges against the Trump Organization and the organization’s chief financial officer, Allen Weisselberg, as soon as this week. Those charges would be in connection with fringe benefits Weisselberg received from the company.

Trump has vehemently denied any wrongdoing and has called the investigation politically motivated.

“He took his brand from being one about luxury and business into one that is political and controversial,” Quint says. “It’s now hard for people to separate the Trump Organization from Trump ‘The Politician.’”

The post Sales at Trump Properties Are Way Up Since Donald Trump Left Office—but at Discount Prices appeared first on Real Estate News & Insights | realtor.com®.